Faculty: Computer Science and Technology

Speciality: Economic Cybernetics

Risk - an economic category. As the economic capital category it represents an event that may happen or not happen. In the event of such an event possible are three economic effects: a negative (loss, damage), zero, positive (gain, profit).

Investment risk - this risk of loss of investment, non of them full benefits, impairment of investments.

Ukraine, joining the WTO, is obliged to participate in the stock market game, because 90-95% of purchases/sales of the WTO is carried out through specialized exchanges. Thus, Ukraine as part of the former Soviet Union has lagged behind in the theory and practice of stock market games. In order to maximize economic benefits and reduce investment risks. The aim of this thesis is to develop a computerized trading system (CBS), which maximizes the yield for the reporting period, and other economic indicators while reducing investment risk. A feature of such CBS is that there exists a subsystem which controls the size of an open trading position, depending on the previous statistics of the computer auction system. To meet this goal it is necessary to solve the following tasks:

The relevance of the research is that first made a heuristic synthesis of CBS, which has adaptive subsystem evaluation values open position. This study has theoretical and practical value because it allows the introduction of sub-evaluation of the value of trade position, not only to improve the economic and technical indicators of the system, but also realize the potential of exchange games.

Scientific novelty of these studies is that the heuristic synthesis of computer trading system is made simultaneously with the synthesis subsystem heuristically control the size of trading positions. This approach allows to significantly improve the economic and technical parameters of CBS, because optimization of the entire system is not adequate to optimize its parts.

The practical result of this work will be to improve the effectiveness of CBS, with the relative growth of the indicators will not be less than 3-5%.

In the study of international development have been found more than a dozen publications on the subject.

National Survey results are not given.

A local survey showed that the matter involved members of the department CSI: Smirnov A, Gizatulin A, Guryanov T and others.

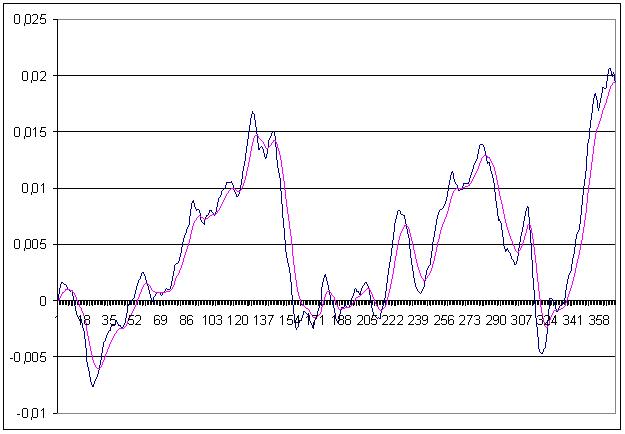

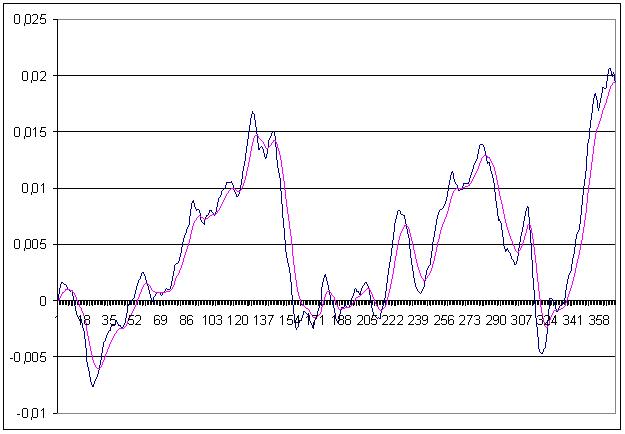

At the time of writing this paper made an adequate amount of degree work, seek expert heuristic theoretical data on the synthesis of a computer trading system (CBS) in the market Forex (EURUSD since January 2002. May 2003.).

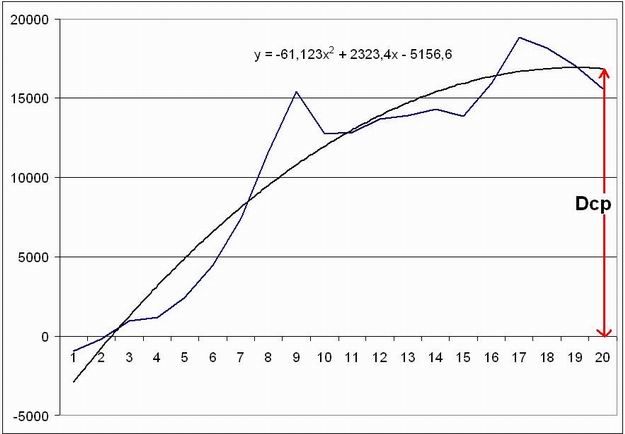

CBS was the most profitable, with N = 8. It has an average yield at the end of the reporting period (Dsr.) amounted to 15.59 thousand den. ed.

Were evaluated by private economic and technical performance of the MAC:

Important reasons, which have become increasingly use the techniques to manage investment risk: strengthening the unevenness of economic development and international integration, the periodic financial crises in various countries, the concentration of risks in bank borrowing, the risks of globalization of economic activity in emerging markets («emerging markets»), the development of off-balance sheet operations of banks, more complex financial needs of their clients.

The study results, which can draw the following conclusions: