Abstract

- Introduction

- 1. Theme urgency

- 2. Goal and tasks of the research

- 3. SCIENTIFIC AND THEORETICAL BASES OF MANAGEMENT OF FINANCIAL RESULTS OF ENTERPRISE ACTIVITIES

- 4. METHODOLOGICAL RECOMMENDATIONS FOR IMPROVING MANAGEMENT OF FINANCIAL RESULTS OF ENTERPRISE ACTIVITIES

- Conclusion

- References

Introduction

In modern conditions of economic development, profit acts as one of the key indicators for assessing the performance of an industrial enterprise. This is what prompts enterprises to seek rational and economically sound methods of managing profits. Profit creates certain guarantees for the continued existence of the enterprise, since only its accumulation in the form of various reserve funds helps to overcome the consequences of the risk that occurs when goods and services are sold on the market.

1. Theme urgency

The relevance of the topic of graduation qualification work is due to the need to analyze the profits of the enterprise as one of the ways to determine the possible reserves for increasing financial results. The main task of the functioning of any enterprise in a market economy is to obtain positive financial results.

2. Goal and tasks of the research

The aim of this work is to further develop the theoretical foundations and develop recommendations for improving the management of the financial results of the enterprise.

Main tasks of the research:

- The definition of the essence of the concept of

financial resul

of the process of formation and distribution of financial result - The study of profit indicators in the enterprise and the identification of reserves for its increase in the enterprise

- Analysis of the dynamics of indicators of financial results in domestic and foreign practice

- The study of the main indicators of the financial performance of an industrial enterprise

- Proposal of measures to improve the management of financial results of the industrial enterprise

Research object: process for managing financial results of an industrial enterprise.

Research subject: principles, methods and tools for managing the financial results of enterprises.

The scientific novelty of the results is that it was proposed to determine the financial results and systematized the procedure for their formation in the Russian Federation, Ukraine and the DPR. The practical value of the work lies in the development of guidelines for improving the mechanism for managing the financial results of industrial enterprises in modern business conditions.

3. SCIENTIFIC AND THEORETICAL BASES OF MANAGEMENT OF FINANCIAL RESULTS OF ENTERPRISE ACTIVITIES

In modern business conditions, one of the dominant economic factors determining the efficiency of an enterprise is the financial result. It is well known that it is precisely that complex indicator that allows us to summarize the results of the production and economic activities of the enterprise and determine the effectiveness of its functioning. After all, the filling of the revenue part of the state budget of the country depends on the correct definition and formation of final indicators on the results of the activities of business units. In this regard, not only its internal users (owners, managers, managers, etc.), but also external (relevant specialized state structures, counterparties, etc.) are interested in the reliability and comprehensibility of information on financial results of managing

Financial results – the results of economic activity of the enterprise and its units, expressed in the form of financial indicators, such as profit (loss), change in the cost of equity, receivables and payables, income [1]. Many researchers have addressed the solution to the complex and multidimensional problem of accounting for financial results. Consider the views of various authors on the concept of financial results of the enterprise (table. 1).

Table 1 – Scientific views on the essence of the concept of financial

result

| Authors (source) definitions | Definition |

|---|---|

| I.T. Balabanov [2] | Under the financial result of the company’s activities, understanding the profit, at the same time notes that the really final result is the one that the owners have the right to dispose of, and in world practice it means net asset growth. |

| G.V. Savitskaya [3] | The financial results of the enterprise are characterized by the sum of profit and profitability: profit is part of the net income that business entities directly receive after selling products. |

| V.V. Bocharov [4] | t considers the procedure for generating the financial results of the enterprise (profit), systematizing the articles included in the profit and loss statement and showing the formation of profit from gross to retained (net) profit (uncovered loss) of the reporting period |

| V.G. Hetman [5] | The financial result is the result of the financial and economic . |

Thus, in our opinion, the definition of a financial result is reduced to the concept of profit or loss received for the reporting period.

In a market economy, every entrepreneur should strive not only to maximize profits, but also to such an amount of profit that would allow the company to develop in a competitive economic environment. Based on the conducted research, the enterprise profit distribution scheme can be presented in the following form (Fig. 1).

Figure 1 – Distribution of profit of the enterprise

(Animation: 5 frames, 7 cycles, 19 KB.)

Part of the profit that remains at the disposal of the heads of the enterprise is divided into two areas. One share of the profit is directed to consumption. The second part is to increase the value of the enterprise and takes part in the accumulation of financial resources of the enterprise. It is not necessary to fully spend the accumulated profit, since this part of the profit has an important reserve value and can be used to cover additional costs for the development of entrepreneurial activity, to replenish working capital, and to cover possible financial losses.

4. METHODOLOGICAL RECOMMENDATIONS FOR IMPROVING MANAGEMENT OF FINANCIAL RESULTS OF ENTERPRISE ACTIVITIES

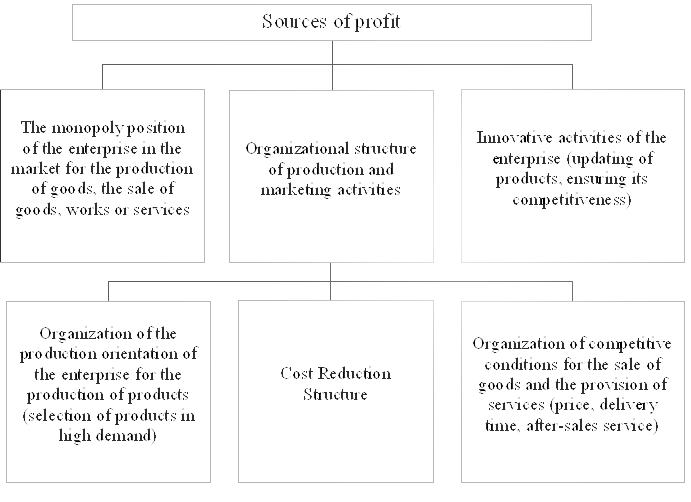

Of great importance in the analysis of the profitability and profitability of an enterprise’s economic activity is the search for possible reserves to increase these indicators for more successful implementation of its economic activity (Fig. 2).

Figure 2 – Sources of potential reserves for increasing profits from sales

In the search for possible reserves for increasing profits, a special role is played by a decrease in the sum of costs for the production and sale of works, goods and services, that is, a decrease in the materials that the company uses in the course of its activities, depreciation of fixed assets, fuel, energy and other expenses [6]. An increase in the amount of profit from the sale of products and a decrease in the cost of manufactured products act as key elements in identifying possible reserves for increasing the level of profitability of products.

Conclusion

Thus, profit as an economic category, which is a general indicator of the financial performance of business entities, can be determined by deducting from the revenue received from the sale of manufactured products, works or services the costs of this activity, expressed in cash.

In a market economy, enterprises should strive for such a profit that would not only save the company its position in the sales markets, but also ensure further development in a competitive economic environment. Increasing profit is a priority, therefore, identifying the potential reserves for maximizing it is the basis for managing the financial results of an enterprise.

References

- Современный экономический словарь Б. А. Райзберга, Л. Ш. Лозовского, Е. Б. Стародубцева.

- Балабанов И. Т. Анализ и планирование финансов хозяйствующего субъекта. – М.:Финансы и статистика. 2005. – 112с.

- Савицкая Г. В. Методика комплексного анализа? хозяйственной деятельности: Краткий курс / Г. В. Савицкая. 4-изд, испр. М.: ИНФРА-М,? 2009. – 498 с.

- Бланк И. А. Финансовый менеджмент: Учебный курс. – К.: Ника-Центр, 2005. -528, с.

- Бочаров, Владимир Финансовый анализ. Краткий курс / Владимир Бочаров. – М.: Книга по Требованию, 2013. – 240 c.

- Л. А. Исаева, Г. Г. Романова, Л. Р. Шурипа, И. В. Родионова, С. В. Гук. Экономическая теория: учеб. пособие для вузов / – Владивосток: Мор. гос. ун-т, 2006.

- Шумпетер Й. А. Теория экономического развития. – М.: Прогресс, 1982.