Abstract

Description

- Introduction

- 1. Theme urgency

- 2. Goal and tasks of the research

- 3. Review of Research and Development

- 4. Methods of forecasting the dinamics of financial markets

- 5. Wavelet vs Fourier transform

- Conclusion

- References

Introduction

The main problem in forecasting and analysis is to construct models that adequately reflect the dynamics of financial time series. The emergence of various external factors are usually not reflected in the history of financial time series, but it is a violation of their dynamics. This is the feature of almost all financial time series. Prediction of changes in financial markets is complicated by the nonlinearity of the processes that do not allow effective use of classical methods such as ARIMA, MACD, due to their large inertia. However, the modern approach is characterized by a change in paradigm. In place of the efficient market hypothesis, arbitrage theory of capital asset pricing model, a mathematical model of Markowitz's theory based on the distribution of the increments of Gaussian random–walk theory comes to the fractal theory. Financial systems are nonlinear systems and have the "butterfly effect", when a very small parameter changes entail major consequences. One of the challenges of modern science is to develop models and methods for accurate prediction of such processes.

1. Theme urgency

Recently, to solve the problem of forecasting complex economic processes and systems emerged and developed such a direction as Econophysics, which is study of economic phenomena, objects, systems and methods of physics [1]. It gave rise to methods of analyzing the frequency characteristics of time series. That these methods focus of this master's work.

2. Goal and tasks of the research

The goal is to evaluate the effectiveness of the methods of discrete Fourier continuation and of the wavelet transform in predicting the dynamics of financial markets.

Main tasks of the research:

- Analysis of existing methods for predicting the dinamics of financial markets.

- Development of methods of forecasting algorithms, discrete Fourier and wavelet transforms.

- Quality assessment in predicting the results obtained.

- Comparative analysis of forecasting by both Fourier and wavelet transforms and the classical methods of forecasting.

Research object: methods of Fourier and wavelet transform.

Research subject: application of Fourier and wavelet transform in predicting the dynamics of financial time series.

3. Review of Research and Development

In the current studies on the prediction, common approaches to extrapolate the trend of time series analytic function [2], the construction of multivariate regression or autoregressive models [3,4], and its extended version – group method arguments [5]. In addition, popular and in demand are the methods based on wavelet transform [6] and the methods of time series prediction based on neural network technology [7].

4. Methods of forecasting the dinamics of financial markets

As a study sample were taken the Forex quotes data in October 2011 with a periodicity in the day, 4 hours, 1 hour, 30 minutes.

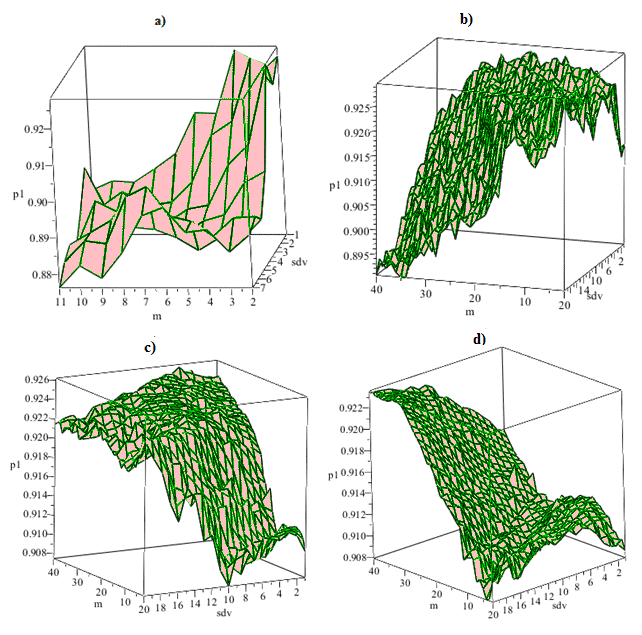

To describe the dependence of the series was suggested by the classical regression model that takes into account two main components of time series – the trend and cyclical component. It has the form:

Forecast was calculated on a subsequent period. The quality of the forecast error of the additive was evaluated using the method of least squares. The calculations were carried out in the software package Maple 15.

Proposed two options for calculating the model:

1st method – the program takes into account the full dependence and calculated once all the parameters of the model;

2nd method – in the first stage of the program identifies the trend (calculated the first two parameters), and then subtracted from the raw data value of the modeled trend, and residue was found a circular dependency (calculated the other parameters).

To derive the calculations obtained in graphical form were used the following indicators:

p1 – the ratio of the actual value of the time series of predicted;

m – the size of the time window;

sdv – the shift of the time window relative to the first element.

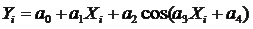

The results of calculations by the first method presented in Figure 1.

Figure 1.The dependence quality of the forecast from the size of time window and its location (1st method) with the periodicity of the data: a) 24 h b), 4 h; c) 1h, d) 30 minutes.

The data presented in Figure 1, we can see that with increasing size of the time window increases the accuracy of the forecast. Deviation of predicted values from the actual amount is not more than 3%, and the effect of shear is smoothed on the quality of the forecast.

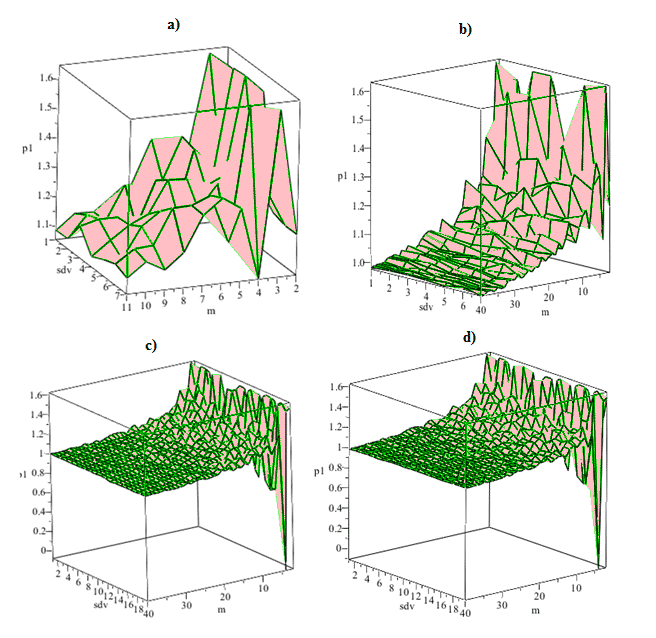

Figure 2.The dependence quality of the forecast from the size of time window and its location (2nd method) with the periodicity of the data: a) 24 h b), 4 h; c) 1h, d) 30 minutes.

The calculation of dependencies this method there is no common characteristic depending on the size of the quality of the forecast time window or the displacement time series. as in the previous case.

The first method forecasting the spread of best to worst prediction accuracy averaged60%, while the second – did not exceed 10 %. In the first method of prediction accuracy was achieved in 95–97 %, and in predicting the second method it varied in the range of 87–93% . The second classical decomposition method is more reliable for forecasting accurate prediction of 90 %.

It should be emphasized that these results are local in nature for the given time interval in a certain stability.

5. Wavelet vs Fourier transform

The classical Fourier transform (FT) is a traditional mathematical tools for the analysis of stationary processes. When the signals are decomposed in the basis of cosines and sinus or complex exponentials. These basis functions are drawn along the time axis.

From a practical point of view the FT has some limitations and drawbacks. Having a good localization in frequency, it has no temporal resolution. FT even for a given frequency signal requires knowledge not only in the past, but in the future, so this is a theoretical abstraction. Moreover, in practice, not all signals are stationary and nonstationary signals increasing difficulty FT repeatedly.

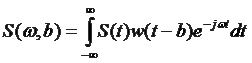

Some of these difficulties be overcome by using a window FT:

which uses pre–multiplication operation signal S(t) on the window

w(t–b), while the window is the local time function (eg, rectangular, then 0 < t < τ and w(t)=0 for t < 0 and t > τ, is moved along the time axis t (Fig. 4) to calculate the FT in different positions. This results in the current spectrum, ie, the frequency–time description of the signal.

Figure 3. Window FT

(animation: 32 frames, 4 repetitions, 113 KB)

If the window shown in Fig. 3, move the jumps (through τ) along the entire lifetime of the signal S(t), then after a certain number of such movements can preview

of the signal.

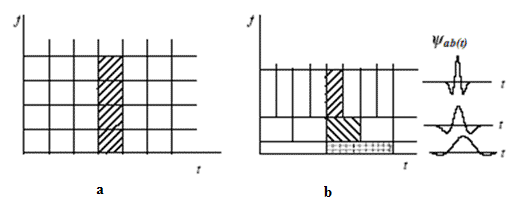

Disadvantage of a window FT lies in the fact that you are using a fixed window, and, therefore, a fixed resolution in time and frequency for all points in the plane of the transformation (Fig. 4.a), which can not be adapted to the local properties of the signal.

WT has a significant advantage over FT by the locality properties of wavelets. In the wavelet transform multiplication by a window is already contained in the most basic function, which narrows and widens the window (Figure 4.b). Moving the frequency–time window allocated equally good and low–frequency and high–frequency characteristics of signals. This property of the WT gives it a great advantage in analyzing the local properties of signals.

Figure 4. Wavelet vs Fourier transform

It is through the identification of local features of the signal, essentially absent in the FT, the WT is widely used to analyze the structure of signals [16].

Conclusion

In the future, will compare the quality of forecasting by classical methods and methods based on the frequency decomposition of time series, such as the Fourier continuation and wavelet transform, and will be developed and implemented additional parameters for assessing the quality of the forecast of financial markets other than Forex.

This master's work is not completed yet. Final completion: December 2011. The full text of the work and materials on the topic can be obtained from the author or his head after this date.

References

- Синергетичні та еконофізичні методи дослідження динамічних та структурних характеристик економічних систем.// Дербенцев В.Д., Сердюк О.А., Соловйов В.М., Шарапов О.Д. – Монографія. – Черкаси: Брама –Україна, 2010. – 287 с.

- Присенко Г.В., Равікович Є.І. Прогнозування соціально–економічних процесів: Навч. посіб. – К.: КНЕУ, 2005. – 378 с.

- Адаптивные методы краткосрочного прогнозирования временных рядов Лукашин Ю.П.: Учеб. пособие. – М.: Финансы и статистика, 2003. – 416 с.

- Бокс Дж., Дженкинс Г. Анализ временных рядов. Прогноз и управление. – М.: МИР, 1974. – 406 с.

- Зайченко Ю.П. Нечеткие модели и методы в интеллектуальных системах: Учеб. пособие. – К.: Слово, 2008. – 344 с.

- Дремин И.М., Иванов О.В., Нечитайло В.А. Вейвлеты и их использование // Успехи физических наук, 2001. – Том 171, №5. – С. 465–501

- Ежов А.А., Шумский С.А. Нейрокомпьютинг и его применения в экономике и бизнесе. – М.: МИФИ, 1998. – 224 с.

- Korotayev A. Kondratieff waves in global invention activity (1900 –2008) / A. Korotayev, J. Zinkina, J. Bogevolnov // Technological Forecasting and Social Change. – 2011. – Vol. In Press, Corrected Proof.

- Brooks C. Detecting intraday periodicities with application to high frequency exchange rates / Brooks C., Hinich M.J. // Journal of the Royal Statistical Society: Series C (Applied Statistics). – 2006. – Vol. 55, 2. – P. 241–259.

- Hinich M.J. Randomly modulated periodicity in the US stock market / Hinich M.J., Serletis A.// Chaos, Solitons Fractals. – 2008. – Vol. 36, 3. – P. 654–659.

- Грицюк П.М. Аналiз, моделювання та прогнозування динаміки врожайностi озимої пшеницi в розрiзi областей України: монографiя / П. М. Грицюк. – Рiвне: НУВГП, 2010. – 350 с.

- Філєр З. Біржові паніки, кризи та Сонце //Энергосбережение, энергетика, энергоаудит, №2 (60), 2009. – С. 49–54.

- Чабаненко Д.М. Дискретне Фур'є –продовження часових рядiв // Системнi технологiї. Регiональний мiжвузiвський збiрник наукових праць. – Днiпропетровськ, 2010. – № 1 (66). – С. 114–121.

- Chabanenko D. Discrete Fourier forecasting of economic dynamic's time series / D. Chabanenko, O. Nechinennaya // Information Technologies, Management and Society. Theses of the International Conference. Information Technologies and Management. – Riga: 2010. – P. 43–44.

- Релятивистская квантовая эконофизика. Новые парадигмы моделирования сложных систем. // Сапцин В.М., Соловьев В.Н.. – Черкассы: Брама –Украина, 2009. – 64 с.

- Яковлев А.Н. Введение в вейвлет –преобразования: Учеб. Пособие. – Новосибирск: Изд –во НГТУ, 2003. – 104 с.