Abstract

Content

- Introduction

- 1. Theme urgency

- 2. Goal and tasks of the research

- 3. An approach to the unification of synthesis of Moore FSM on FPGA

- Conclusion

- References

Introduction

Modern banking activity is inconceivable without risk. The risk represents an uncertainty element which can affect activities of this or that accounting entity or carrying out any economic transaction. Here and the bank can't work without risk, as well as any of risk types can't be completely overcome. As the purpose of activities of bank is receipt of the maximum profit, it is necessary to pay huge attention to implementation of the transactions in case of minimum possible risks. In order to avoid bankruptcy and liquidation, to achievement and preserving a steady position in the market of banking services banks need to look for and apply effective methods and management tools these risks. Specific risks which banks most often face will determine results of their activities. Therefore, while there are banks and banking activities, there will always be relevant and significant a risk management of banks and a problem, related.

1. Theme urgency

The relevance of the subject chosen by me consists that the risk is inherent in any sphere of human activities that is connected with a set of the conditions and factors influencing a positive outcome of the decisions made by people therefore studying of risks in banking activity requires a special attention.

In modern research literature considerable experience in questions of assessment and credit risk management is accumulated. So, among foreign scientists essential researches in this direction were conducted: L. Schuster, G. Birman, S. Schmidt, R. Solow, E. Altman, H. Mauser, D. Rosen and others. Works of domestic researchers among which there are A.P. Algina, I.V. Balabanov, M.A. Kovrigin, A.A. Lobanov, S.N. Kabushkin, A.V. Plyakin, G.V. Chernov, I.V. Voloshin, A.S. Shapkin, V.V. Chistyukhin and others are of great value.

Studying of works of domestic and foreign authors revealed that questions of assessment and credit risk management in modern conditions remains debatable, and therefore requires a further system research.

2. Goal and tasks of the research

The purpose of this work is development of actions for enhancement of process of management of credit risks.

Main tasks of the research:

- To study theoretical bases of risk management in commercial bank.

- To consider the main methods of management of credit risks.

- To consider an evaluation procedure of creditworthness of borrowers.

- To study an evaluation procedure of degree of a credit risk.

- To develop methods of enhancement of process of management of a credit risk.

Research object: Activities of commercial bank. .

Features of credit risk management act as a subject of the term paper.

The methods of scientific research used when writing work are: a systematization method (an arrangement of data in the logical sequence), analysis methods (decomposition of data on components for the purpose of studying) and synthesis (generalization of data), a tabular method, analytical, a forecasting method (development of the forecast, the prospects of development), etc.

3. Sources overview

Now, in the conditions of an economic crisis the problem of studying of bank risks is relevant not only for erudite and bank specialists, but also for the legal, and physical persons using services of banks. Bank risks by the nature, it is process social, the products and services offered by bank are connected with money. In critical situations banks risk not only own, but often and the raised funds. Therefore, bank crises infringe on the interests of the widest range of the numerous clients who entrusted to banks the money.

Identification of possible risks at early stages and effective management of them becomes more and more necessary aspect of economic activity, the quality of risk management exerts direct impact on stable functioning of each direction of the banking sector, especially in the conditions of crisis. For this reason, the phrase "risk management" even more often meets in scientific research, the standard and regulating documents concerning the banking sector.

3.1 World sources overview

Conceptual provisions of the theory of risk are determined in works of foreign scientists, such as: U. Beck, F. Knight, N. Luman, J. Mill, N.U. Senior, A. Marshall, A. Pigu, J.M. Keynes.

At the same time, it is important to note that interpretation of risk still is disputable. Rather often its determination comes down to possible outcomes and consequences, namely:

The risk as danger is the situation involving failure, damage, a loss, cash losses. So, U. Beck considers that the risk is a systematic impact with threats and dangers.[1].

Risk as an opportunity Ð N. Luman studied in detail, according to him, the risk can be expressed as opportunities, and refusal of risk, in particular in modern conditions, would mean refusal of rationality. [2].

Risk as uncertainty Ð one of the first F. Knight who offered the theory of measurement of uncertainty as variabilities of variety of the decisions giving the chance of risk management researched. [3].

3.2 National sources overview

In domestic practice the theory of risk in all the variety became demanded among scientists only from the beginning of transition to the market relations and commerce development. The risk is a satellite of any business activity, and bank Ð in particular. This problem and now, opposite financial globalization, technological progress didn't lose the relevance, economic crises don't reduce risks, and often contribute to the development of new.

In the education guidance "Bank risks" of Lavrushin O.I. the credit risk is determined as risk of failure to carry out of credit liabilities to credit institution, the third party[4].

In the scientific article Celina M.A., "Bank risks and methods of their assessment" the credit risk is determined as risk of origin at credit institution of losses owing to non-execution, untimely or incomplete execution by the debtor of financial liabilities before credit institution in accordance with the terms of the agreement[5].

In the book by Sviridov O.Yu., "Banking" the credit risk is provided as risk of default of a principal debt and percent on the issued loan [6].

3.3 Local sources overview

At the Donetsk National Technical University at "Finance and Economic Safety" department problems of credit risk management were considered and covered in publications.

Article PhD Econ., associate professor Gennady Manerov under the name "Credit Risk Management of Bank in Modern Conditions" was published in one of publications of materials of the International scientific and practical conference "Institutional and Evolutionary Problems of Development of Financial Credit Systems"[7].

"Use of the Data mining tools in credit risk management" by authors of this article PhD Econ., associate professor Slepnyova L.D. and Krivoberets V.B. [8].

Under Bodnya D.I. authorship and Slepnyova L.D. wrote the scientific article "Assessment of a credit risk on the basis of VAR methodology"[9].

4. Main contents of the thesis

In introduction the relevance of a subject of the master's thesis is proved, the purpose and research problems are formulated, an object, a subject and methods of a research, the scientific importance and practical value of a research is determined.

In the first section of the master's thesis "Theoretical basics of credit risk management" were covered the basic concepts, types, factors of credit risks of banking activity, controlling mechanisms by credit risks in commercial banks are determined, credit policy of bank is specified and evaluation methods of a credit risk are analysed.

The bank risk is a probability of emergence of losses in the form of loss of assets, short-reception of the planned income or emergence of additional expenses as a result of implementation of financial transactions by bank.

Interpretation of bank risks still is ambiguous. In domestic economic literature it is possible to meet the most various risk identifications, but all of them come down to one Ð the aforesaid.

The commercial bank, as well as any accounting entities operating in conditions of market economy in case of implementation of the activities is aimed at receipt of the maximum profit. Besides that activities of bank are exposed to influence of the general risks peculiar to accounting entities, the risks following from specifics of activities are characteristic of it. The specifics of risk of banking activities are that that risk degree which the bank assumes is substantially determined by that risk degree which he objectively or subjectively receives from the clients. The risk degree, business of clients of bank inherent in type is higher, the risk which can expect bank is higher, working with these clients. The transactions connected with attraction in the money market of temporarily available funds and placement them in different types of assets (including in the credits) cause special dependence of commercial banks on financial stability of their clients and also on a condition of the money market and economy of the state in general. The bank risk logs in economic risks in which it at the same time is an independent type of risk. The question of risk analysis in economy is very important as decision making process in the conditions of information uncertainty is closely connected with it.

Management systems credit risks are the cornerstone search and development of actions for their overcoming or in decrease in a risk degree if it can't be avoided that can't be performed without systematization of different types of credit risks.

We will consider further classification of credit risks.

On origin sources such risks divide on external and internal [10].

The external credit risk is such credit risk in case of which insolvency or a default of the borrower resulted from negative impact of the external environment on its activities.

Internal credit risk Ñ emergence of insolvency or the borrower's default in connection with the activities which are carried out by him. That is when the borrower entity inefficiently manages the resources which are available at its order [6].

The most detailed classification of risks is shown in Figure 1.

Figure 1 Classification of credit risks

(animation: 7 frames, 144 kilobytes)

Credit risks are the most frequent reason of bankruptcies of banks in this connection, all regulating boards establish standards on credit risk management. Among measures for counteraction to these risks ? accurately formulated policy of the organization for credit risks and establishment of parameters on which credit risks will be controlled. Such control includes restriction of credit risks by means of policy which provides sufficient diversification of a credit portfolio.

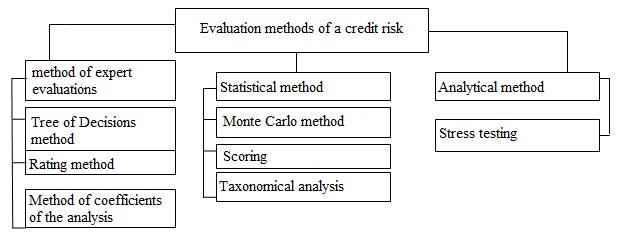

All methods of assessment of a credit risk differ with methods and forms of assessment which are based on personal experience of the credit expert. As shown in the figure 2, act as main types of systems of assessment of a credit risk: methods of expert evaluations, statistical methods, analytical methods [11].

Figure 2 Ð Evaluation methods of a credit risk

In the second section of the master's thesis "A research of impact of risks on activities of JSC Gazprombank" the characteristic of JSC Gazprombank was considered, assessment of credit risks of commercial bank was also determined and the comparative characteristic of standard rates of credit risks between Sberbank of Russia and Gazprombank is carried out.

JSC Gazprombank takes strong positions in the domestic and international financial markets, being one of the Russian leaders in the organization and underwriting of releases of corporate bonds, to asset management, in the sphere of private banking, corporate financing and other areas of investment banking.

Being universal commercial bank, JSC Gazprombank grants the loans to enterprise customers of various industries of economy and physical persons. The greatest share of crediting it is sent to an industry of trade and commerce. The negative characteristic of a credit portfolio of bank is availability of an overdue debt and its growth. The specific weight of an overdue debt in a credit portfolio of 01.01.2017 made 4,5% though for 01.01.2016 it was at the level of 2,9%, and for 01.01.2015 - 4,0%. The greatest amount of overdue loans has an overdue debt over 180 days. At the same time dynamics of standard rates of the maximum credit risk for the analyzed bank has the level which meets a standards.

In the third section of the master's thesis ways of optimization of credit risks of commercial bank JSC Gazprombank are specified.

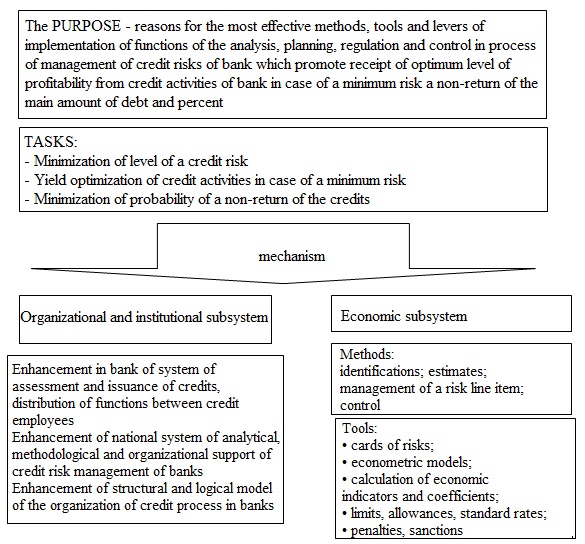

The purpose of enhancement of credit risk management of bank are reasons for the most effective methods, tools and levers of implementation of functions of the analysis, planning, regulation and control in process of management of credit risks of bank which promote receipt of optimum level of profitability from credit activities of bank in case of a minimum risk of a non-return of the main amount of debt and percent on the credits. we bank which promote receipt of optimum level of profitability from credit activities of bank in case of a minimum risk of a non-return of the main amount of debt and percent on the credits. The concept of enhancement of the controlling mechanism by a credit risk of JSC Gazprombank it is shown in fig. 3.

Figure 3 Concept of enhancement of the controlling mechanism credit risk of bank

The most essential elements of process of crediting, the quality of management of which provides a possibility of prevention of origin and elimination of an essential share of possible credit risks, both in the conditions of stable economic development, and in the conditions of crisis and recession, planning of credit activities, designing of a credit product, assessment of a credit risk of each separate transaction, limitation and monitoring of a current status of a credit portfolio and borrowers is.

Conclusion

Based on the conducted research economic content of bank credit risks is determined. The credit risk is the dominating element of hierarchical system of bank risks and an inseparable component of an overall bank risk. Credit risk management represents the multi-level, strictly regulated process where each participating division has the accurate list of the purposes, the tasks reached by accomplishment of functions through the system of the interconnected and interdependent methods of deliberate impact for non-admission of approach of a risk event.

At the moment there is a set of banks and all of them because of specifics of the activities are subject to a credit risk. It is possible to minimize a credit risk if very carefully to choose borrowers, to analyze conditions of issuance of credit, and also, to control behind execution by the borrower of all liabilities on debt repayment within carefully developed system of assessment and credit risk management.

This master's work is not completed yet. Final completion: May 2018. The full text of the work and materials on the topic can be obtained from the author after this date.

References

- Beck U. society of risk. On the way to other modernist style. M.: Progress-Tradition, 2000. 383 pages.

- Luman N. Concept of risk//THESIS. 1994. Issue 5. Page 4-160.

- Knight F.H. Risk, uncertainty and profit. M.: Case, 2003. 360 pages.

- Bank risks: the textbook / under the editorship of O.I. Lavrushin, N.I. Valentseva. 3rd prod., reslave. and additional M.: KNORUS, 2016. 292 pages.

- Selina M.A. Bank risks and methods of their assessment (with consideration of an example in practice)//the IV International student's electronic scientific conference "Student's Scientific Forum" M.: North Caucasian branch of the Moscow humanitarian and economic institute, 2012. Page 64. (Collection).

- Banking: 100 examination answers / O.Yu. Sviridov. Ñ The edition 3rd corrected and additional Ñ Rostov N / „: Publishing center "Mart"; Phoenix, 2010. 256 pages (The express reference book for students of higher education institutions).

- Manerov, GM "Managing the Bank's Credit Risk in Modern Conditions" / / Materials of the International Scientific and Practical Conference "Institutional and Evolutionary Problems of Development of Financial-Credit Systems". - Donetsk: Bravo, 2013. - 150 pages.

- Slepneva, LD, Krivoberec, VB "Using Data mining tools in credit risk management" // Scientific and practical journal "Economy of Industry". - Donetsk: IEP NAS of Ukraine, 2013, No. 1-2 (61-62), p. 303 - 312.

- Bodnya, D.I., Slepneva, L.D. "Credit Risk Estimation Based on VAR Methodology" // Proceedings of the Fifth All-Ukrainian Scientific Conference of Students and Young Scientists "Actual Problems of the Development of the Financial-Credit System of Ukraine". - Donetsk: DonNTU, 2012.

- Beloglazova G.N. Banking. Organization of activities of commercial bank: textbook / G.N. Beloglazova, L.P. Krolivetskaya. - M.: Yurayt, 2011. - 422 pages.

- Kabushkin S.N. Management of a bank credit risk [Text]: education guidance / S.N. Kabushkin. - M.: New knowledge, 2012. - 332 pages.