Actuality of theme. The research of problems of investment of economy always was at the centre

of attention of economic sciences. It is caused that the investments mention the most deep bases of economic

activity, determining process of economic growth in general.n modern terms they are the most important means of ensuring the conditions to

overcome the economic crisis that has arisen, structural changes in economy, technical progress, increase the quality of economic

activity on the micro and macro levels.

The economic situation in Ukraine is now

more difficult for investment: development of the investment mechanism, adequate

to the market relations is required. The investment processes of each country

are closely connected of each general economic development. The activization of

investment activity during economic stagnation , not only contributing to

replacement of outdated fixed capital, but also is an indispensable condition of

introduction in production of the newest scientific and technical achievement.

The purpose of the master's work is further development of theoretical, methodological approaches and development of the practical recommendations for evaluating and improving the efficiency of investment processes in the Ukraine, as well as developing recommendations for its development.

To achieve this goal is formulated in complex tasks:

The object of the investment processes are being planned and implemented in the Ukraine.

Research methods. Theoretical and methodological basis of the master's work are the classical position of economic theory, the fundamental work of scientists and practitioners on the investment processes and increase their efficiency.

Analysis of recent studies and publications. The issues of investment and the investment process involved both foreign and domestic scholars, including W. Behrens, L. Gitman, Samuelson [1], J. Honko, I.A Blank [2], A.D Dubrava, I.J Dorosh, M.I Kisil, M.Y Kodenska, I.V Lipsyts, A.V Mertens, A.A Peresada, G.M Pidlisetskyy, P.S Rohozhin, P.T Sabluk, V.P Savchuk, O. Starikov, T. Khachaturov, V.M Hobta [3], V.J Shevchuk and others. However, the questions connected to efficiency of investment processes, sources of financing and methods of activization of investment activity of the enterprises remain unsufficiently worked. Necessity and practical importance of the decision of these questions have caused a choice of a theme of research.

First section — "Theoretical bases of investment processes" to reveal the essence of investment, the analysis of the current state of investment

processes in Ukraine, to identify factors to activate and enhance effectiveness.

A modern economic situation in Ukraine considerably complicates investment activity (political, economic instability high

level of inflation, etc.) [4]. According to official data of State Statistics Committee of Ukraine for years of independence

the parameters of development of economy had the negative tendency, but since 2000 the improvement

of separate parameters was achieved. Since 1998, the rise in capital investment — an increase of 6,1%.

Dynamics of macroeconomic indicators is reflected in the table 1.

| Year | GDP | Volumes of industrial products | Investments in the fixed assets |

|---|---|---|---|

| 1995 | 87,8 | 88 | 71,5 |

| 1996 | 90 | 94,9 | 78 |

| 1997 | 97 | 99,7 | 91,2 |

| 1998 | 98,1 | 99 | 106,1 |

| 1999 | 99,8 | 104 | 100,4 |

| 2000 | 105,9 | 112,4 | 114,4 |

| 2001 | 109,2 | 114,2 | 120,8 |

| 2002 | 105,9 | 107 | 108,9 |

| 2003 | 109,3 | 115,8 | 127,7 |

| 2004 | 112,1 | 112,5 | 128 |

| 2005 | 102,7 | 103,1 | 101,9 |

| 2006 | 107,1 | 106,2 | 119 |

| 2007 | 107,9 | 110,2 | 129,8 |

| 2008 | 102,1 | 96,9 | 97,4 |

| 2009 | 85,2 | 80,1 | 58,9 |

| 2010 | 101,3 | 112,5 | 99,4 |

Dynamics of foreign investments in Ukraine is characterized by large

fluctuations. So in 2000-2005, observed an annual increase of foreign

investments in Ukraine (348% in 2005 to level 2004), but already in 2006 the

total investment flows declined sharply from 7843.1 million. U.S. 4717.3

million. USA. A distinctive feature of the investment processes in Ukraine

is to reduce the state's role as an investor and development of private

investment, the main source of investment for most domestic enterprises that

presently their own funds, which significantly limits the expansion and

improvement of production efficiency [5].

W ith a comprehensive point of view, the term "investments"

can be defined as follows: investment is investment in various sectors of

economy in the facilities business and other activities for profit (income)

and to achieve other economic or non-economic effect.

The second chapter deals with the development of regulations to improve

the efficiency of investment processes and methodical approaches to the

evaluation of investment projects.

Today date, the mechanism of investment company

is in process of formation. Investment activity serves as the main form of economic

strategies that promote successful problem solving business. Problems of functioning

of investment activity in industrial enterprises and some of its elements is given serious

attention today. However, analysis of current practice shows that the mechanism of regulation

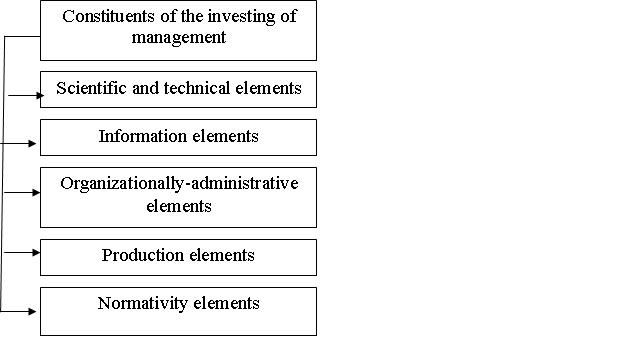

of investment processes (Fig. 1) requires further improvement.

Picture 1 — Constituents of mechanism of management by investment activity

In terms of improvement of

investment activity in industrial enterprises now much attention is paid to the

use of strategic approaches. Indeed, the main purpose of investment in the

company should be to ensure the most effective ways to implement its investment

strategy, which acts as a system of long-term goals, resulting from the general

objectives of development and investment ideology [ 10].

The decision on whether individual investment is determined by the procedure

evaluate their effectiveness. The research gives good reason to assume that the

low efficiency of investment in our country to some extent determined by the

imperfect tools for project appraisal. Therefore, comprehensive financial and

economic evaluation of investment projects has a special place in the

justification of the choice of alternative investment investment resources. To

ensure the dynamic development of industry is possible with the development of

optimal strategies for financing of investment programs and the procedure for

assessment of their effectiveness in the calculation of risk factors. While

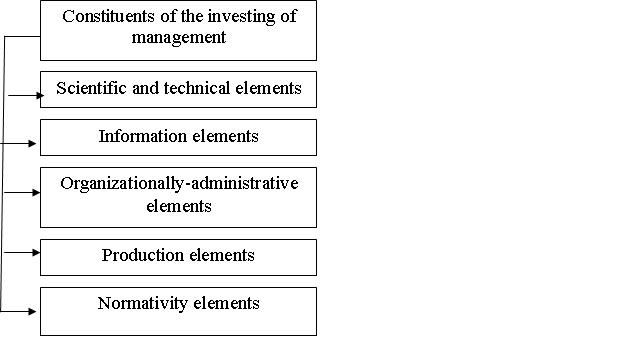

financial and economic evaluation to determine the level of performance most

used in modern practice are the following figures. (Pic. 2).

Picture 2 — Performance evaluation of investment

When making decisions in the company of long-term investments are

needed in forecasting performance. It is necessary to conduct long-term

analysis of revenues and expenses listed in terms of figure 2, which are

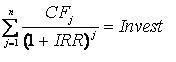

calculated by the following formulas [7]:

(1)

(1) (2)

(2) (3)

(3) (4)

(4)The method of selection of investment projects based on the list of criteria is considered compliance of each criterion and each of them is evaluation. The method allows to highlight the advantages and disadvantages of the project. In compiling the list of criteria to use only those arising from the objectives, strategies and objectives of the company, the orientation of its long-term plans.

The third chapter involves the development of practical recommendations to improve methods of evaluation of the investment performance. This evaluation must begin at the stage of calculating the values of key performance indicators. To solve the problem of increasing the efficiency of business investment, primarily to develop the complex mechanism of investment activity, one that will allow to adequately assess the implementation of planned projects, to detect possible threats and risks of investments and make necessary adjustments.

The research methodology selection of investment projects is the need to develop criteria to assess the effectiveness of investment in industrial enterprises. In deciding which of the indicator to follow when deciding on the feasibility of the project, you must use a variety of economic methods. Their substantiation and practical use in industrial enterprises of Ukraine will be devoted to further investigation.

Note!

At the time of writing this summary the master thesis was not yet completed. The deadline for completion is December 2010. Full text of the work and materials on the topic can be obtained from the author or his supervisor after that date.