Improving the environmental and economic assessment of the enterprise

Content:

- Introduction

- Assessment of the environmental and economic efficiency of the project

- Analysis of current methods for assessing the environmental and economic safety of an enterprise

- The concept of assessing the economic efficiency of production aimed at environmentally sustainable development of the enterprise

- Analysis of the level of investment attractiveness of an industrial enterprise

- Conclusion

- Bibliography

1. Introduction

Environmental problems in recent years have attracted more and more attention in all countries of the world. This is due to both a significant increase in the consumption of natural resources and a catastrophic deterioration in the state of the environment, the task of resolving the conflict between economic and environmental interests.

The creation and improvement of the economic mechanism of nature management is impossible without assessing the current situation in the interaction of the economy and ecology, as well as without presenting possible ways of ecological and economic development in the future.

The problems associated with assessing the effectiveness of socio-economic systems in general and at different levels require their addition and clarification. It is accepted to define economic efficiency as the efficiency of the economic system and to express it by the ratio of the useful end results of its functioning and the resources expended.

In assessing the environmental and economic efficiency of the criteria and parameters that stimulate the processes of greening production, and the definition of environmentally friendly production, it is revealed as an organizational unity of technological processes based on the best available technologies, forms of economic activity, which increases the environmental and economic efficiency of production.

2. Assessment of the environmental and economic efficiency of the project.

Environmental and economic efficiency of the project - & nbps; indicator characterizing the ratio of total economic benefits and losses from the project, including external environmental effects, and related social and economic consequences affecting the interests of the population and future generations as a result of the implementation of this project.

Environmental Impact Assessment (hereinafter referred to as EIA) is a type of activity aimed at identifying, analyzing and accounting for direct, indirect and other consequences of the environmental impact of a planned economic and other activity in order to make a decision on the possibility or impossibility of its implementation.

The problem aimed at assessing the ecological and economic efficiency of the planned economic activity directly depends on the development of the relationship between nature and society. Determining environmental and economic efficiency in real time is a very difficult task, since the environmental, social and moral consequences of harm to the environment do not reflect quantitative expression and cannot be reflected in the economic assessment of the company's economic activities.

Most developing countries, large international organizations apply the procedure for environmental assessment of projects. Preserving the environment - improving the entire organization of production, introducing and applying advanced nature and resource-saving technologies and techniques, as well as restoring a disturbed ecological balance.

The assessment of the ecological and economic efficiency of investment projects is characterized by the fact that the predicted long-term effect is directly added to the economic effect, which takes into account all the ecological and economic consequences of environmental changes in the future.

The environmental and economic efficiency of a project means an indicator that determines the correspondence of the general economic benefits and costs of a project to economic activity, including external environmental effects and associated social aspects, as well as financial results from the implementation of this project.

The ecological and economic assessment of the effectiveness of projects is focused on identifying in monetary terms the results of this influence and the use of the accumulated information in the financial analysis of an investment project.

The result of the analysis is the identification of the most suitable way to use funds in the course of the implementation of this project, provided that the specific parameters of the state of the environment are preserved.

Primary data for the assessment are taken from certain sections of the project documentation and reporting, drawn up based on the results of the initial stages of work on environmental impact assessment (EIA). The information obtained is the most important in preparing a feasibility study for an investment project and making a final decision on the participation of a potential investor in the project.

To date, the assessment of environmental and economic efficiency implies great difficulty for the investor, since the existing approaches in most cases are focused on determining the factors of negative impact and drawing up measures to reduce their impact on the environment.

Investment projects are assessed according to many criteria, for example, from the point of view of social significance, the degree of involvement of labor resources, the level of investment risk, as well as the scale of environmental impact, and others. However, it should be noted that the most important place in these estimates belongs to the economic efficiency of projects.

Efficiency in general means the compliance of the results obtained from the investment project - not only economic (profit), but also non-economic (improving the welfare of society) costs.

The task of assessing the environmental results of investment projects can be divided into assessing changes in the quality of the environment and assessing damage.

The environment is understood as a complex of abiotic and biotic environments acting as a combination of natural and natural-anthropogenic components that have a direct and indirect impact on humans and natural resource characteristics of the functioning of national economic objects of different levels and social economy as a whole, not only in the present, but also the future.

The quality of the surrounding natural environment means its ability to interact with society, taking into account the long-term possibility of performing a function: human life and his environment, a source of natural resources and an absorber of production and consumption waste residues, as well as the species diversity of flora and fauna.

The quality of the environment can be regarded as the degree of deviation of its actual biological, physical and other parameters from their optimal values that determine the natural state of the environment. Such deviations are considered as environmental violations.

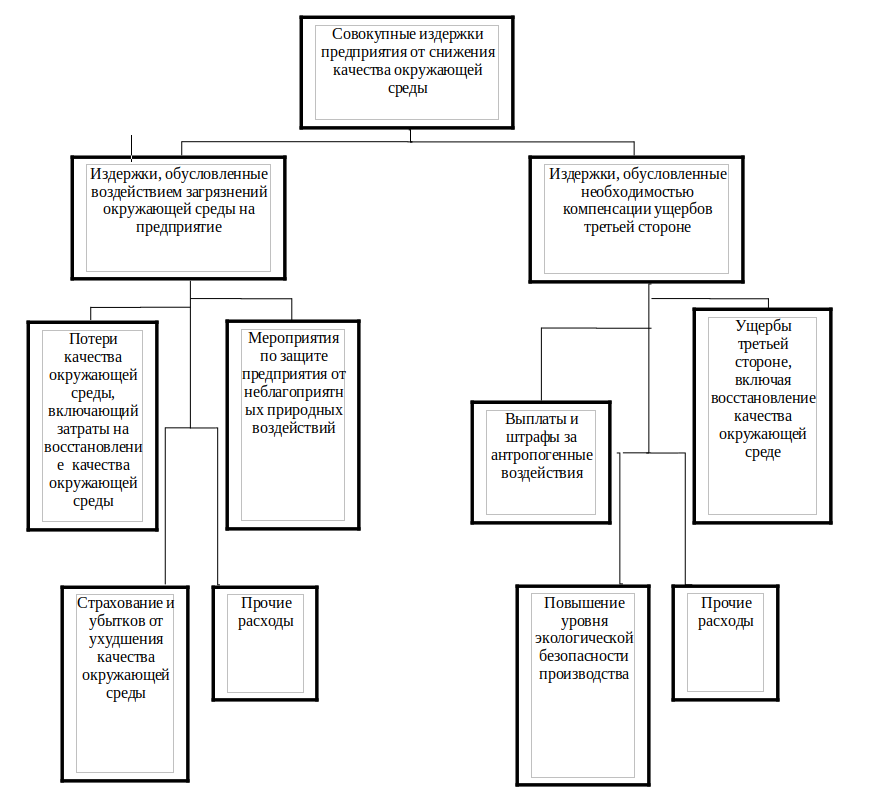

In addition, there is another economic aspect in the environmental area of the investment project. The so-called risk-analysis, which in turn is associated with environmental costs, ie, with an assessment of the damage that a company can incur in connection with the direction of the worse environmental quality, and the costs associated with the implementation of lowering their level.

Ultimately, we can say that such an assessment of an ecological and economic project makes it possible, by calculating in financial terms the consequences of impact on the ecological environment, to determine the characteristics of the effectiveness of an investment project and to give an opinion on the possibility and feasibility of its implementation, as well as to analyze the factors not taken into account in the monetary valuation ... In addition, it will be possible to evaluate projects taking into account the environmental and economic factor.

The purpose of assessing the environmental and economic efficiency of projects is to include in the project analysis of the environmental aspects (associated with this project environmental costs and benefits) of the planned activity, expressed in value terms, by comparing the total economic benefits from the planned project and the associated costs from unforeseen negative impacts on environment.

The objectives of assessing the environmental and economic efficiency of projects are:

- obtaining quantitative criteria for making decisions on the admissibility or inadmissibility of the project;

- ensuring the choice of a variant of the planned economic activity with the lowest environmental and social costs;

- obtaining quantitative criteria for evaluating the effectiveness of the proposed project of treatment equipment and planned environmental protection measures;

- selection of an acceptable rate of return for the society during project implementation;

- obtaining quantitative criteria for environmental and economic assessment of the effectiveness of the system of state environmental impact assessment

Assessment of the ecological and economic efficiency of projects is an integral part and the second stage of environmental impact assessment (EIA), aimed at determining in monetary terms the consequences of this impact and using the data obtained in the economic analysis of the project.

When assessing the environmental and economic efficiency of projects (of any type), standard principles and procedures of economic analysis are applied.

When assessing the social effectiveness of projects, external effects (environmental costs and benefits) are recommended to be taken into account in quantitative form. According to the World Bank's Operational Policy on EIA, environmental costs and benefits should also be quantified whenever possible, and where appropriate, the economic value of natural and environmental benefits should be indicated.

The main principles of the ecological and economic efficiency of projects, allowing to take into account external and social effects, include:

- inclusion of environmental costs and benefits in cash flows taken into account in project analysis and cash flow modeling;

- use as a time horizon for the analysis of the entire period of the project's impact on the environment and population, including after the end of the project, and not just the period of the project's life cycle;

- taking into account the time factor as one of the tools to reflect the long-term environmental and social consequences of the project;

- the spread of the spatial boundaries of the project to the boundaries of its impact on the environment, natural and artificial ecosystems and natural complexes, taking into account possible consequences at different levels of project impact - & nbps; local, regional, national;

- modeling surrogate markets to determine the value and value of natural goods, markets for which are absent or undeveloped;

- elimination of the risk of double counting of costs and benefits;

- taking into account the possibility of underestimating environmental benefits and natural benefits in the analysis due to the lack of data, difficulties in obtaining them, and description of these benefits and benefits in qualitative terms;

- a flexible choice of methods and calculation methods, based on the availability of methods suitable for assessing the consequences of a certain type of impact and their feasibility, the availability of initial information, the time of analysis and available financial resources;

- comparison of socially desirable results and private interests to analyze the possibility of eliminating the emerging contradictions at the early stages of decision-making and analysis of the distribution of benefits and costs between the various parties affected by the project.

- the use of cost-effectiveness analysis when it is inexpedient or impossible to conduct a traditional cost-benefit analysis, for example, in cases where the benefits cannot be presented in monetary terms;

- comparison of environmental impact options “with a project” and “without a project” and in some cases using a “shadow project” analysis.

- comparison of various options for projects to take into account alternative options for planned activities, including the option of abandoning activities for the economic justification of the option proposed for implementation.

3. Analysis of current methods for assessing the environmental and economic safety of an enterprise

The development of an enterprise economy implies a reasonable balance between effective efficiency and business sustainability, which ultimately ensure its survival.

Business entities and authorities at all levels have historically always sought to stimulate the rapid growth of the economy, thus guaranteeing the solution of socio-economic problems, improving the living standards of citizens and sustainable development of society. However, the issues of economic evolution cannot be considered in isolation from ensuring the stable functioning of the business. Security research solves the problem of protection from various types of threats. At the same time, interaction and conflicts of interest in the political and legal, business, and public spheres. Economic security management is provided with appropriate process resources for the interconnection of the interests of carriers who are agents of both the external and internal environment of the enterprise, the significance of the influence of which determines the measure of its resistance to external and internal threats. The range of such influences can vary from opposition, i.e. full immunity, until the consequences of threats are eliminated, i.e. full blown vulnerability. The influence of the enterprise on threats is also possible. In practice, there are various ways to improve the economic security of an enterprise. In most cases, they are strategically directed, accompanied by processes of high-quality organizational, innovative, investment changes and create the preconditions for the stable and effective development of the organization. full blown vulnerability. The influence of the enterprise on threats is also possible. In practice, there are various ways to improve the economic security of an enterprise. In most cases, they are strategically directed, accompanied by processes of high-quality organizational, innovative, investment changes and create the preconditions for the stable and effective development of the organization. full blown vulnerability. The influence of the enterprise on threats is also possible. In practice, there are various ways to improve the economic security of an enterprise. In most cases, they are strategically directed, accompanied by processes of high-quality organizational, innovative, investment changes and create the preconditions for the stable and effective development of the organization.

Until recently, many market operators focused only on achieving important, but often momentary business interests. Modern realities are such that maintaining a balance between commercial feasibility and the need to preserve the environment is one of the most important tasks of the reindustrialization model of the domestic economy being introduced. In most cases, industrial activity has negative environmental consequences that appear either immediately or in the future. All this has led to the fact that at the present stage of human development, the issues of environmental and economic security at the micro, macro and mega levels have become relevant. In some cases, intermediate mesoscale levels are additionally considered. Often, the resulting effect from a particular economic activity can be compared with the environmental and economic damage to which it leads. A similar situation, for example, developed with the work of the Baikal Pulp and Paper Mill, where the losses associated with the destruction of the ecosystem, according to some estimates, exceeded the monetized benefits from production activities. Quite a few researchers see the solution to the issue of stabilizing the ecological situation in the development and implementation of appropriate economic reforms. The need to study environmental and economic security, in addition to the reasons already mentioned, is associated with the high uncertainty of the external environment. The presence of a large number of threats and challenges in it contributes to the emergence of new risks, different in nature and the nature of the impact.

Determination of the main problems of assessing the environmental and economic safety of an enterprise on the basis of an analysis of existing methods in this area, development of an algorithm for the practical choice of an assessment method and determination of selection criteria.

The issues of diagnostics of the economic security of the enterprise were studied by D.V. Belkin, V.A. Bogomolov, G.V. Kozachenko, V.P. Ponomarenko, O. M. Lyashenko, L.A. Chagovets and others. Research in the field of assessing the environmental safety of an enterprise belongs to such scientists as A.M. Dolzhenko, N.A. Strakhova, K.S. Olekseenko. Some aspects of ecological and economic security at the regional level were developed by N.E. Buletova, N.N. Skeeter, I.A. Zlochevsky, E.Yu. Trunov. The ecological and economic security of enterprises in the complex was considered in the works of A.B. Aydarova, N.L. Nikulina, G.A. Reznik, A.A. Malysheva, A.V. Zatonsky.

Certain methodological approaches to assessing the environmental and economic sustainability of enterprises and problems in solving related problems are considered in the works of the following authors: A.I. Agadullina, K.S. Alekseenko, A.M. Barlukov, I.S. Belik, D.V. Belkin, M.T. Gilfanov, A.V. Zatonsky, E.A. Ivantsova, A.A. Ilchenko, A.S. Karelov, N.V. Kolacheva, M.I. Kopytko, V.A. Kuzmin, A.A. Kunitskiy, I.A. Kucherin, V.V. Lepikhin, A.A. Malyshev, O.S. Onatskaya, A.I. Orlov, S.Sh. Palferova, Yu.K. Persky, V.A. Petrenko, M.M. Redina, A.F. Rogachev, L.S. Samal, E.V. Semenova, N.A. Strakhova, A.A. Shevchenko, A.N. Yarygin and others.

The presence of a sufficiently large number of methods for assessing the economic and environmental components of enterprise safety and at the same time the practical absence of a methodology for studying environmental and economic safety in a complex confirms the need for a more detailed study of this issue, taking into account the multifactorial nature and complexity of the process. Based on the Pareto rule of thumb, it is preferable for managers to focus their attention and main resources on factors related to the "critical minority". This category in relation to safety forms the main potential threats to the economic and environmental sustainability of the organization. At the same time, the "trivial majority" of factors is considered insignificant and practically not taken into account. This approach allows you to optimize the system model, but significantly reduces the effectiveness of countering threats. The reason for the high uncertainty of their impact on business lies in the multidimensionality of the tasks to be solved, which is predetermined by the difficulties in choosing the evaluation criteria, a large number of factors, stochasticity and multiplicity of their combinations.

The urgent need to develop a comprehensive methodology for assessing the environmental and economic safety of a company, taking into account the greatest possible number of destabilizing aspects. In the economic literature, attempts have been made to determine the optimal methodology for assessing the safety of an enterprise. Assessment of economic security consists in the study of sustainability, which is ensured primarily by the coordination of management and production processes.

Methods used in assessing the economic and environmental safety of an enterprise

| Method | Feature | User Authors |

|---|---|---|

| Expert judgment | When making management decisions, it is assumed to use judgments highly qualified specialists (experts) presented in the form of high-quality and quantifying object | A.I. Agadullina, K.S. Alekseenko, M.T. Gilfanov, V.V. Lepikhin, Yu.K. Persky, E.V. Semenova, ON. Strakhova |

| Multicriteria Optimization | This is a process of simultaneous optimization of two or more objective functions that conflict in specific domain of definition. Used in multipurpose tasks. The advantage of the method is its applicability in various conditions: certainty, uncertainty and risk. | A.I. Agadullina, N.V. Kolacheva, A.I. Orlov, S.Sh. Palferova, A.N. Yarygin |

| System Analysis | The scientific method of cognition, which is a sequence of actions to establish structural links between variables and system elements. The peculiarity of the method is creating the basis for a logical and consistent approach to the problem of decision making. The solution of complex tasks (problems) in the framework of system analysis is carried out through decomposition them into simpler tasks (problems). | I.S. Belik, D.V. Belkin |

| Multivariate Statistical Analysis | Provides for the construction of optimal plans for collecting, organizing and processing data. The information should be aimed at identifying the nature and structure of the relationship between components of the investigated multidimensional attribute. Data is meant to draw conclusions scientific and practical. The most commonly used method within multivariate statistical analysis is factor analysis. The task of factor analysis is the procedure for determining partial factors affecting the change in the effective indicator. The form of functional and stochastic dependence between performance and factor indicators. | V. V. Lepikhin, Yu.K. Persky, M.M. Redina, L.S. Samal, E.V. Semenova |

| Fuzzy Logic | Used to formalize a person's ability to make imprecise or rough judgments. The use of the fuzzy logic method is advisable in cases where there is no possibility clearly formalize the data, and expert linguistic verbal assessment prevails | E.A. Ivantsova, V.A. Kuzmin, A.F. Rogachev, A.A. Shevchenko |

| Environmental and economic modeling | Environmental and economic modeling & nbsp; & ndash; & nbps; is a description of economic and environmental processes in their relationship in the form of an ecological and economic model. The degree of participation of environmental and economic factors may vary | A.M. Barlukov, A.V. Zatonsky, A.A. Ilchenko, A.S. Karelov |

| Indicative | Assumes comparison of real indicators with target indicators that are determined at the beginning, according to the main goal of the system development. Indicators are viewed as limiting values of indicators characterizing the activities of the enterprise in various functional areas corresponding to a certain level of economic security. Indicators of economic security & nbsp; & ndash; & nbps; these are indicators of the level of economic security enterprises, allowing to identify vulnerabilities in its activities, to determine the main directions and the most effective ways to improve work efficiency. Feature indicative method is the need for constant clarification of the value of indicators, in as a result of systematic changes in the external and internal environment of activity enterprises. In this case, there is a need for permanent adjustment of indicators, which are indicators of the economic security of the enterprise, which entails increase in the labor intensity of management work and, as a result, the addition of new specialists. | M.I. Kopytko, A.A. Kunitsky, I.A. Kucherin, A.A. Malyshev, O.S. Onatskaya, V.A. Petrenko |

The methods can be used to assess the environmental and economic safety of an enterprise both separately and in conjunction. In practical implementation, the multicriteria optimization method requires the use of a complex mathematical apparatus. Currently, the use of more than two target functions is difficult due to insufficient development of this issue in the field of enterprise management. Within the framework of systems analysis, the decomposition process is often accompanied by the loss of structural links. This affects the quality of the result. One of the most common analytical methods for studying environmental and economic security at the macro and micro levels is the indicative method. The fuzzy logic method is increasingly used in monitoring sustainability in complex production systems, because it avoids redundant data formalization. A combination of expert assessment and factor analysis is often quite effective. This methodology, for example, was used to certify the environmental and economic stability of oil and gas enterprises and the copper industry. Factorial modeling of the organization's security architectonics sets as its task the analytical modeling of the transformation of its material and positional market status, the transformation of the basic properties and interactions in the organizational structure. was used to certify the environmental and economic stability of oil and gas enterprises and the copper industry. Factorial modeling of the organization's security architectonics sets as its task the analytical modeling of the transformation of its material and positional market status, the transformation of the basic properties and interactions in the organizational structure. was used to certify the environmental and economic stability of oil and gas enterprises and the copper industry. Factorial modeling of the organization's security architectonics sets as its task the analytical modeling of the transformation of its material and positional market status, the transformation of the basic properties and interactions in the organizational structure.

The above methodologies assume a static or dynamic assessment of the economic security of an industrial enterprise. The combination of these two directions allows the development of systematized quotation schemes, linking diverse aspects from the point of view of space and time. Such an approach, for example, is proposed for studying the sustainable development of industrial enterprises.

Analysis of the methodologies for assessing the environmental and economic safety of an enterprise made it possible to determine that most researchers concentrate their attention on individual components of the economic sustainability of an object, which, in fact, cannot be recognized as wrong, and sometimes turns out to be the most practical solution. However, this approach periodically violates the dominant principle of coordinated integrity as the basis for the economic sustainability of the system.

The importance of interaction between industrial companies and nature, the implementation of measures to protect the external environment is confirmed by attention to these issues at the highest levels. Existing methods for assessing the environmental component of enterprise safety often lead to distorted results. Incorrectness in such cases is due to ignoring the economic aspects of the problem, which is inappropriate in modern market conditions.

At the enterprise, it is necessary to assess the environmental and economic safety to justify the priority measures and develop a strategy for achieving high performance efficiency. In practice, managers find it difficult to navigate the variety of safety assessment methods and, as a result, make an informed choice of those suitable for their company in the current circumstances. Selection is often done on a whim. At the same time, as analysts emphasize, the selection of the method is an integral part of the procedure for ensuring the economic and environmental safety of the enterprise. As the studies have demonstrated, each of the methods, as a rule, is combined with indicators of a specific typology, and also requires certain materials, conditions and resources for evaluation. Hence, the manager must choose not only the most suitable method for his enterprise, taking into account the type of activity, size, form of ownership, but also the one that is least complex, easy to use, can be provided with the data available to the organization. At the same time, it is important that the shortest possible time period is required for effective implementation. Understanding the features of various methods is necessary to select the one that is most appropriate in conducting research for a particular enterprise. At the same time, it is important that the shortest possible time period is required for effective implementation. Understanding the features of various methods is necessary to select the one that is most appropriate in conducting research for a particular enterprise. At the same time, it is important that the shortest possible time period is required for effective implementation. Understanding the features of various methods is necessary to select the one that is most appropriate in conducting research for a particular enterprise.

If the capabilities of the available assessment methods do not match the criteria, then the selection conditions should be adjusted. To simplify the procedure for choosing a method, you can use a universal scale containing levels: very low, low, medium, high, very high. The systematization and mutual positioning of factors presuppose predicates of preference or indifference. The differentiated approach depends on the type of criterion. For example, the estimation of the time spent on carrying out calculations can be carried out in the scale suggested above, and the periods of calculations in the ranges: short-term, medium-term and long-term. In the process of making a selection for maximum correspondence to the tasks being solved, the scale can change in the number and length of gradations. A set of criteria, along with enterprise-specific, the manager should include common components that describe the methods and how they are used by the organization. The most significant among them are the availability of the necessary data for the implementation of the method and their availability, the required staff skills, time costs, the ability to carry out calculations on their own or with the involvement of third-party specialists, the cost of calculations. Given the importance and unpredictability of the outcome, the selection process can, and sometimes should, be iterative. At the same time, the possibility of coordinated evolution of criteria should be envisaged. the ability to carry out calculations on their own or with the involvement of third-party specialists, the cost of calculations. Given the importance and unpredictability of the outcome, the selection process can, and sometimes should, be iterative. At the same time, the possibility of coordinated evolution of criteria should be envisaged. the ability to carry out calculations on their own or with the involvement of third-party specialists, the cost of calculations. Given the importance and unpredictability of the outcome, the selection process can, and sometimes should, be iterative. At the same time, the possibility of coordinated evolution of criteria should be envisaged.

The most significant criteria for selecting a method for assessing environmental and economic security and their possible gradations.

Selection criteria for the range of exposure and the ranking scale:

a) application possibilities - direct and indirect;

b) the scale (level) of coverage of problems - national, regional, sectoral, enterprises;

c) the period of possible impact and relevance of the results obtained by the method - long, medium, short;

d) attitude to parametric changes, preservation of objectivity during modifications - flexible, relatively adaptable, static;

e) the scales used for the data obtained are special, of the universal type;

f) the applicability of the results of the method in different situations - universal, limited variability, specific.

Selection criteria for the required resources for the method and the ranking scale:

a) data requirements for the breadth of the problem - minimal, small, extensive;

b) the qualifications of the specialists conducting the analysis by the method - high, medium, low;

c) time costs for making a choice - high, relatively acceptable, low.

It should be noted that in extraordinary cases the choice is very limited and depends on the evolution of the fundamental foundations of the economic sector, the territorial cluster, and the state. In the context of global changes (transformation of the political and legal status and economic environment, natural disasters), expert assessment is often the only method that gives any objective results. The method of expert assessments does not require continuous series of statistical data and makes it possible to get by with basic information interpreted by experts on the basis of knowledge, taking into account the accumulated experience. In contrast to the fuzzy logic method, this method allows one to formalize the data and results quite definitely. At the same time, this method has a number of disadvantages and limitations in its application. A high degree of subjectivity in the judgments of each individual forces them to turn to several experts, sometimes their groups, or use complex multi-level techniques, for example, the Delphi method. As a result, for the maximum objectification of qualimetry, important resources are spent - & nbps; human (for collecting and processing data), time (depends on the communication means in the expert group) and finances (highly qualified experts are expensive and not always available due to involvement in other projects). Nevertheless, objectively, when carrying out the option procedure, it was the method of expert assessments that obtained the most acceptable result for enterprises. for example the Delphi method. As a result, for the maximum objectification of qualimetry, important resources are spent - & nbps; human (for collecting and processing data), time (depends on the communication means in the expert group) and finances (highly qualified experts are expensive and not always available due to involvement in other projects). Nevertheless, objectively, when carrying out the option procedure, it was the method of expert assessments that obtained the most acceptable result for enterprises. for example the Delphi method. As a result, for the maximum objectification of qualimetry, important resources are spent - & nbps; human (for collecting and processing data), time (depends on the communication means in the expert group) and finances (highly qualified experts are expensive and not always available due to involvement in other projects). Nevertheless, objectively, when carrying out the option procedure, it was the method of expert assessments that obtained the most acceptable result for enterprises.

The results formed a certain methodological basis for managing the environmental and economic safety of enterprises. At the same time, the problems of mechanisms for ensuring the security of strategic development processes, monitoring and diagnostics of these processes, the design of effective management tools have not been fully resolved at the moment. The lack of coordination between the approaches, methods of assessing the security of an enterprise and strategic management of its activities necessitates the intensification of research in the field of risk factors, their impact on entrepreneurial activity, and the development of methodological support.

One of the most important basic directions for the development of enterprise security is the development and improvement of workable algorithms for selecting methodologies for predicting and assessing potential threats.

4. The concept of assessing the economic efficiency of production aimed at environmentally sustainable development of the enterprise

The metallurgical industry, characterized by a complex of natural polluting and environmentally destructive industries, accounts for about 10% of all pollution entering the atmosphere and water bodies. More than half of enterprises of ferrous and non-ferrous metallurgy discharge untreated wastewater in the form of liquid solutions containing toxic organic and inorganic compounds, salts of heavy non-ferrous metals, arsenic, antimony, cyanides, and petroleum products. The region's copper complex, represented mainly by Holding LLC, is one of the largest sources of environmental pollution, both in terms of the amount of waste produced and in terms of emissions into the atmosphere. One of the strategic directions of the Holding LLC activity is a more complete extraction of all valuable components of raw materials, complex processing of solid waste with additional recovery of metals and waste disposal, the use of closed water use schemes. The indicated directions correspond to the course of production greening. Applying fundamentally new technological solutions, individual enterprises have the potential to obtain the status of "environmentally friendly production", since at present the methods of obtaining blister copper, processing waste meet the requirements of BAT, for which the decisive production and technical factors are: "purity of technology", energy efficiency, innovativeness of technical and technological solutions.

Currently, the system of indicators for assessing the efficiency of copper industry enterprises includes such as: reducing the cost of production, saving fuel and energy resources, etc.

In assessing production efficiency, the economic burden of an economic entity from the negative impact on the environment in the form of payments for pollution of the environment was also taken into account.

Despite a certain information content, the listed indicators cannot comprehensively characterize the environmental activities of an enterprise, and cannot be used as targets for assessing the prospects for the company's economic growth.

In the economic practice of enterprises, production efficiency depends on a large number of interrelated factors. Each industry has its "own" set of factors, which differ due to its technical and economic characteristics, however, all the variety of factors of efficiency growth can be classified according to the following criteria:

1. According to the sources of efficiency improvement (resources used). The group combines indicators identified by the type of resource used (to reflect the main source of efficiency growth), these include indicators of a decrease in the capital intensity of production, rational use of natural resources, etc. The criterion of efficiency in this group is cost minimization.

2. In the areas of development and improvement of production. This group combines indicators for which the increase in efficiency is associated with an increase in the potential of the system due to the intensification of activities (acceleration of scientific and technical progress; increase in the technical and economic level of production; improvement of the structure, forms and methods of organizing production), greening production. In this group, the efficiency criterion is the maximization of the result.

The assessment of the environmental and economic efficiency of production is carried out not only to analyze and control the current activities of the company, but also for forecast purposes. In this regard, indicators for assessing the environmental and economic efficiency of production should be reflected in the system of making management decisions for the economic development of an enterprise and in the formation of programs to improve the efficiency of its functioning.

The decision of the development of the company LLC "Holding", in the strategic plan, allows to form scenarios of economic development based on target indicators that set the limiting modes of economic functioning, preventing depletion and degradation of the environment. The introduction of the amendment in the long term will make it possible to implement the proposal to introduce into practice a distinctive sign that can be identified as an intangible asset. Introduce additions to submitters to obtain information on the organization's compliance with established environmental requirements and risk assessment. Develop a format for documents containing information that affects the value of a company when buying and selling (about environmental pollution, about changes in natural resources resulting from past activities).

5. Analysis of the level of investment attractiveness of an industrial enterprise

Initial data matrix for assessing the investment attractiveness of enterprises

| Indicator name | Indicator values for the enterprise | |||

|---|---|---|---|---|

| A | B | IN | D | |

| 1 Profitability indicators: 1.1 Product profitability,% | 60.7 | 4.0 | -1.2 | 0.39 |

| 1.2 Profitability of sales,% | 33.0 | 0,4 | -3.4 | -0.48 |

| 1.3 Return on assets,% | 18.3 | 0.5 | -11.5 | -0.18 |

| 1.4 Return on equity,% | 19.7 | 0.6 | -14.6 | -0.30 |

| 2 Indicators of business activity 2.1 Asset turnover ratio | 0.55 | 1.45 | 3.43 | 0.37 |

| 2.2 capital productivity, e.u. / d.e. | 1.86 | 1.34 | 3.70 | 0.49 |

| 2.3 The turnover ratio deb. arrears | 3.86 | 23.1 | 21.20 | 0.56 |

| 2.4. Credit turnover ratio. arrears | 7.84 | 9.56 | 16.16 | 0.81 |

| 2.5 Inventory turnover ratio | 0.52 | 6.74 | 22.07 | 0 |

| 3 Indicators of financial stability, liquidity and solvency 3.1 Current liquidity ratio | 12.46 | 1.44 | 1.85 | 0.92 |

| 3.2 Quick Ratio | 2.90 | 0.37 | 1.16 | 0.92 |

| 3.3 Absolute liquidity ratio | 0.08 | 0.00 | 0.32 | 0.07 |

| 3.4 Coefficient of providing current activities with own circulating assets | 0.92 | 0.31 | 0.46 | -0.09 |

| 3.5 The coefficient of maneuverability of own working capital | 0.01 | 0.01 | 0.38 | -0.87 |

| 3.6 Equity capital flexibility ratio | 0.78 | 0.12 | 0.21 | -0.07 |

| 3.7 Equity concentration ratio | 0.94 | 0.78 | 0.80 | 0.52 |

| 4 Indicators of the potential of securities 4.1 Dividend return on securities,% | 11.8 | 15.5 | 0 | 0 |

| 4.2 Profit (loss) per CU authorized capital, c.u. / d.e. | 0.75 | 0.05 | -0.20 | 0.13 |

| 4.3 Payment ratio,% | 15.7 | 1 hundred | 0 | 0 |

The coefficients of weighting of indicators are determined using expert judgment. A well-known approach is when indicators are divided into four groups. Each group has its own weighting factor. There are four groups in total. The first includes indicators of profitability of the enterprise ( K i = 0.1), the second - indicators of business activity ( K i = 0.2), the third - financial stability and liquidity ( K i = 0.3) i in the latter - shares potential indicators ( K i = 0.4).

Weights, as well as the relative coefficients of the state of the enterprise for individual indicators of economic activity are used in calculations using the method of complex assessment .

For each analyzed enterprise, the value of the rating assessment of its investment attractiveness can thus be calculated by the formula:

The third approach is based on the use of the sum of seats method . For each indicator, enterprises are ranked by location. Then the places for all indicators are summed up. The best overall rating is the company with the smallest number of seats. This method is less accurate as all coefficients are "equal".

Rating of the investment attractiveness of enterprises by individual indicators, the overall rating and place of the enterprise calculated by different methods

|

Until bearer |

Rating of indicators taking into account their weight (except for MSM) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MSC | MCO | MSM | ||||||||||

| A | B | IN | D | A | B | IN | D | A | B | IN | D | |

| 1.1 | 0.1 | 0.006 | -0.002 | 0.0006 | 0.081 | 0.098 | 0.999 | 0.999 | 1 | 2 | 4 | 3 |

| 1.2 | 0.1 | 0.001 | -0.010 | -0.001 | 0.081 | 0.099 | 0.999 | 0.999 | 1 | 2 | 4 | 3 |

| 1.3 | 0.1 | 0.003 | -0.063 | -0,0009 | 0.081 | 0.099 | 0.999 | 0.999 | 1 | 2 | 4 | 3 |

| 1.4 | 0.1 | 0.003 | -0.072 | -0.001 | 0.081 | 0.099 | 0.999 | 0.999 | 1 | 2 | 4 | 3 |

| 2.1 | 0.032 | 0.084 | 0.2 | 0.021 | 0.187 | 0.168 | 0.128 | 0.191 | 2 | 3 | 1 | 4 |

| 2.2 | 0.100 | 0.072 | 0.2 | 0.0265 | 0.162 | 0.172 | 0.128 | 0.108 | 3 | 2 | 1 | 4 |

| 2.3 | 0.33 | 0.2 | 0.183 | 0.005 | 0.089 | 0.128 | 0.133 | 0.198 | 4 | 1 | 3 | 2 |

| 2.4 | 0.097 | 0.118 | 0.2 | 0.0100 | 0.163 | 0.155 | 0.128 | 0.162 | 2 | 4 | 1 | 3 |

| 2.5 | 0.004 | 0.061 | 0.2 | 0 | 0.198 | 0.176 | 0.128 | 0.2 | 3 | 4 | 2 | 1 |

| 3.1 | 0.3 | 0.035 | 0.044 | 0.022 | 0.147 | 0.279 | 0.274 | 0.286 | 1 | 3 | 4 | 2 |

| 3.2 | 0.3 | 0.038 | 0.12 | 0.095 | 0.147 | 0.278 | 0.232 | 0.245 | 1 | 3 | 2 | 4 |

| 3.3 | 0.075 | 0 | 0.3 | 0.065 | 0.257 | 0.3 | 0.147 | 0.262 | 4 | 1 | 2 | 3 |

| 3.4 | 0.3 | 0.101 | 0.15 | -0.029 | 0.147 | 0.242 | 0.216 | 0.999 | 1 | 2 | 3 | 4 |

| 3.5 | 0.08 | 0.008 | 0.3 | -0.687 | 0.254 | 0.295 | 0.147 | 0.858 | 3 | 2 | 1 | 4 |

| 3.6 | 0.3 | 0.046 | 0.081 | -0.027 | 0.147 | 0.273 | 0.253 | 0.999 | 1 | 2 | 3 | 4 |

| 3.7 | 0.3 | 0.249 | 0.255 | 0.166 | 0.147 | 0.169 | 0.166 | 0.208 | 1 | 2 | 4 | 3 |

| 4.1 | 0.304 | 0,4 | 0 | 0 | 0.194 | 0.144 | 0,4 | 0,4 | 4 | 3 | 1 | 2 |

| 4.2 | 0,4 | 0.027 | 0.107 | 0.069 | 0.144 | 0.379 | 0.318 | 0.038 | 1 | 3 | 4 | 2 |

| 4.3 | 0.063 | 0,4 | 0 | 0 | 0.055 | 0.144 | 0,4 | 0,4 | 4 | 3 | 1 | 2 |

| R j | 3.385 | 1,852 | 2,487 | 1.175 | 2,762 | 3.418 | 7.194 | 9.55 | 39 | 46 | 49 | 36 |

| A place | 1 | 3 | 2 | 4 | 1 | 2 | 3 | 4 | 2 | 3 | 4 | 1 |

The method of the sum of the coefficients determines - & nbps; generalizing indicator of the comparative assessment of the investment attractiveness of the enterprise. The disadvantage of this method is the possibility of a high assessment with a significant lag in some initial indicators due to significant achievements in others. After analyzing, we found that enterprise A is more attractive for investment, and LLC Holding is less attractive.

The complex assessment method is used in cases where it is required to more accurately assess the negative aspects of the enterprise. Based on the analysis, we can say that enterprise B is more risky, while LLC "Holding" is reliable.

The sum of places method - for any indicator, the set of analyzed values is ordered from best to worst in such a way that the best value is assigned the best place. This method is less accurate. After analyzing, we can say that enterprise A is more attractive for investment, and enterprise B is less, since the amount of places is more important.

Conclusion

In assessing the environmental and economic efficiency of the criteria and parameters that stimulate the processes of greening production, and the definition of environmentally friendly production, it is revealed as an organizational unity of technological processes based on the best available technologies, forms of economic activity, which increases the environmental and economic efficiency of production.

The problems associated with assessing the effectiveness of socio-economic systems in general and at different levels require their addition and clarification. It is accepted to define economic efficiency as the efficiency of the economic system and to express it by the ratio of the useful end results of its functioning and the resources expended.

For this, in the first section of the study, based on a critical analysis, it was revealed that there are many contradictions in the definition of the basic terms that reveal the content of investment activities. At the same time, from the position of a systematic approach, the essence of investments, an investment project, investment and investment activity was disclosed and a generalized scheme of the investment activity of an industrial enterprise was proposed, which unites these categories into an integral unity.

In the second section of the work, the main problems of investment activity at enterprises of the post-Soviet space were considered, and their solutions were proposed.

In the third section of the study, a classification of factors and reserves for increasing the level of investment attractiveness of an enterprise was proposed, which determines the financial, economic, social and information factors. Based on the analysis of the state of the industrial enterprise, the current directions of increasing the efficiency of investment processes at the enterprise were determined. The main ones are: effective use of tangible assets, improving the economic condition of the enterprise, managing the distribution of profits, quality, marketing policy, pricing for the company's products, monitoring prices for raw materials and component parts, ensuring the environmental safety of equipment, the appropriate use of labor resources, information systems and information.

Further, in the fourth section of the work, a comparative analysis of the level of investment attractiveness of the LLC Holding company was carried out using the method of complex assessment, the method of the sum of coefficients and the method of the sum of seats.

Thus, we can say that the set objectives of the research were fulfilled, and the object of research was fully disclosed. At the same time, as a result of the research carried out, scientific results were achieved, characterized by scientific novelty.

Bibliography

-

Басовский, Л. Е. Экономическая оценка инвестиций: учеб. пособие для вузов / Л. Е. Басовский, Е. Н. Басовская. – М.: ИНФРА-М, 2007. – 241 с.

-

Бланк, И. А. Основы инвестиционного менеджмента / И. А. Бланк. – 2-е изд., перераб. и доп. – К.: Эльга ; Ника-Центр, 2008. – 672 с.

-

Богатин, Ю. В. Инвестиционный анализ : учеб. пособие для вузов / Ю. В. Богатин; Всерос. заоч. фин.- эконом. ин - т. – М.: ЮНИТИ, 2010. – 286 с.

-

Вахрин, П. И. Инвестиции: (Практ. задачи и конкретные ситуации): учеб. пособие для вузов / П. И. Вахрин. – М.: Изд.-торг. корпорация «Дашков и К», 2008. – 212 с.

-

Зимин, И. А. Реальные инвестиции: учеб. пособие для вузов / И. А. Зимин. – М.: ЭКМОС, 2000. – 304 с.

-

Инвестиции / К. В. Балдин, О. Ф. Быстров, И. И. Передеряев, М. М. Соколов; под ред. К. В. Балдина. - 2-е изд. – М.: Изд.-торг. корпорация "Дашков и К", 2007. – 288 с.

-

Инвестиции: учеб. пособие / Г. П. Подшиваленко, Н. И. Лахметкина, М. В. Макарова [и др]. – М.: КНОРУС, 2007. – 176 с.

-

Корпоративные ценные бумаги как инструмент инвестиционной привлекательности компаний / А. Н. Асаул, М. П. Войнаренко, Н. А. Пономарева [и др.]; под ред. А.Н. Асаула; Санкт-Петербург. гос. архит.-строит. ун-т и др. – СПб.: АНО "ИПЭВ", 2008. – 288 с.

-

Марголин, А. М. Экономическая оценка инвестиций: учеб. для вузов и техникумов / А. М. Марголин, А. Я. Быстряков – М.: ЭКМОС, 2009. – 204 с.

-

Маховикова, Г. А. Инвестиционный процесс на предприятии: учеб. пособие для вузов / Г. А. Маховикова – СПб.: Питер, 2001. – 176 с.

-

Филин, С. А. Инвестиционные возможности экономики и решение проблемы неплатежей / С. А. Филин. – М.: ООО “Фирма Благовест–В”, 2009. – 512 с.

-

Хобта, В. М. Активізація і підвищення ефективності інвестиційних процесів на підприємствах : монографія / В. М. Хобта, О. Ю. Попова, А. В. Мєшков; НАН України, Ін-т економіки промисловості; Донец. нац. техн. ун - т. – Донецьк, 2005. – 346 с.

-

Хэгстром, Р. Дж. Инвестирование. Последнее свободное искусство / Р. Дж. Хэгстром; пер. с англ. И. В. Татариновой. – М.: ЗАО "Олимп-Бизнес", 2005. – 288 с.

-

Чернов, В. А. Инвестиционный анализ: учеб. пособие для вузов / В. А. Чернов; под ред. М. И. Баканова. – 2-е изд., перераб. и доп. – М.: ЮНИТИ-ДАНА, 2007. – 159 с.