|

Introduction

1. Concept of optimum f at a reinvestment arrived

2. Search of optimum f

3. Fractional static f

4. Methods of forming of optimum dynamic f

5. Comparative analysis of methods of forming of optimum dynamic f

Conclusion

List of literature

INTRODUCTION

Profitable growth is the key to long-term creation of cost, and none of processes of management renders greater influence on profitability of growth, what management a capital. Now a management a capital is an important task in any system which in any case is related to the reinvestment arrived. It corresponds an aggressive investment policy. Such systems can be: auction systems, investment activity, portfolio management, etc. A competent management a capital allows, foremost, for minimum terms to increase an original capital.

Management a capital – it that can be used all of traders. But, as a rule, effectively to utillize a management a capital, traders must have exact historical registration arrived loss. Although some traders do not utillize the certain system, to date many traders have a certain type of the trade system (approach). The well tested system of trade helps traders to provide the stable results of trade on future transactions within the limits of normal statistical scopes. Clearly, that it is statistical scopes which give wonderful possibility both for an effective and for skilled management an account. By a basic method by which traders study to determine these statistical scopes, there is a large selection of the tested transactions.

This theme is aktuall, as now in Ukraine a management a capital is while in the developing stage.

Concept of optimum f at a reinvestment arrived

For any separate system it is possible to expose an optimum sum which it is possible to risk at every auction possibility. Trading in the optimum sum of money will result in the enormous winning on an account. If traders risk or greater, or by a less dollar sum, they will “do” a less money. ( It takes a place because a greater risk not necessarily results in the greater winning. It is a good example of nonlinear influence at a management a capital.) On this account, it is important to know optimum f for the system. If traders trade without the account of size of optimum f, then they limit the potential profit of the trade system substantially. However, there can be a desire and (or) reason to act so at some, at other – no.

Before to begin trade, it is necessary to define what amount to trade and what position to open. An amount depends not only on balance on an account, and is also a function some other variables: supposed loss of the worst case in a next transaction; to speed which our account grows with; dependences on past transactions. The stake of account, which it is necessary to utillize for trade, will depend on many variables, it is necessary to collect all of these variables, including the level of balance of account, in the total to accept a subjective enough decision in relation to that, how many contracts or actions to trade in.

Most traders do not spare due attention the problem of choice of amount. They consider that this choice to a great extent is casual, and does not matter, what amount to utillize, it is important only that, as far as they are right in regard to direction of trade. Moreover, there is the erroneous impression, that exists direct dependence meantime, how many contracts to open, and that, how many it is possible to win or lose in time. However, a relation between the potential winning and amount is not expressed a straight line. It is a curve. This curve has a peak, and exactly on this nosedive the maximal potential winning is arrived at.

A not trader manages prices, and not on him depends, a next transaction will be profitable or unprofitable. However amount of contracts, which he opens, depends only on him. Therefore resources will be utillized with a greater return, if to choose a correct amount.

Threshold of geometrical trade

For such approach one of by-products of optimum f is used is a threshold of geometrical trade. Essentially, the threshold of geometrical trade talks, in what point it is necessary to be commuted on trading in the fixed stake, supposing that we begin to trade in the fixed amount of contracts.

We will consider an example with the throw of coin, where we win 2 dollars, if a coin falls on a right side, and lose a 1 dollar, if it falls on the back. We know that optimum f= 0,25, I.e. a 1 rate on each 4 dollars of balance of account. If we trade on the basis of permanent amount of contracts, on the average win 0,50 dollars for a game. However if we will begin to trade in the fixed stake of account, can expect winning in 0,2428 dollar on unit for one game (at geometrical middle trade). We will assume, we begin with a primary account in 4 dollars and do a 1 rate for one game. Eventually, when an account is increased to 8 dollars, sle- blows to do 2 rates for one game. However much 2 rates, increased on geometrical middle trade 0,2428 dollar, will give in the total 0,4856 dollar. Is not it better to adhere to a 1 rate at the level of balance 8 dollars, because our expectation for one game still will be 0,50 dollar? Answer — «yes». Reason is in that optimum

Ò = ÀÀÒ / GAT * Most loss/ -f,

ãäå Ò = Threshold of geometrical trade;

ÀÀÒ = middle arithmetic transaction;

GAT = middle geometrical transaction;

f= optimal f (from 0 to 1). For our example with the throw of coin(2 to I):

Ò=0,50 / 0,2428*-1 / -0,25 =8,24

It is therefore necessary to pass to trading in two contracts, when account of uveli- chitsya a to 8,24 dollar, but not to 8,00 dollars. Picture 1 illustrates the threshold of geo- of metrical trade for a game from 50% chances of winning of 2 dollars and 50% shan- owls of loss of a 1 dollar. Mark that the bottom of curve of threshold of geometrical trade corresponds optimum f. A threshold of geometrical trade is the optimum level of balance for a transition from trading in one unit to trading in two units. Therefore if you utillize optimum f, able to pass to geometrical trade at the minimum level of balance of account.

There are a few methods of determination of dependence between the sizes of winnings and losses. We will consider a serial test.

For certain events (such, as a stream arrived losses on transactions), wherever dependence can be certain by verification, it is possible to utillize a serial test. He will show, whether our system has more (or less than) periods of the successive winnings and losses, what casual distributing.

Purpose of serial test — to find the account of Z for the periods of winnings and losses in system trade. The account of Z is meant by a remoteness from the mean value of distributing (expectation of the casual distributing of periods of winnings and losses) on the certain amount of standard deviations. Account of Z is simply number of standard deviations, on which information fall behind from the mean value of normal distribution of probability. For example, the account of Z means in 1,00, that information which are tested is declined on a 1 standard deviation from a mean value.

If a negative value has an account of Z, at the calculation of confiding border it is necessary to take his absolute value. The negative account of Z talks about positive dependence, that less than, than at normal distribution of probability bars are, and consequently, winnings are generated by winnings, and losses are generated by losses. The positive account of Z talks about negative dependence, that more than at normal distribution of probability bars are, and consequently, winnings are generated by losses, and losses are generated by winnings.

A serial test in the presence of dependence automatically takes the percent of winnings and losses into account. However much a serial test on the periods of winnings and losses takes into account the sequence of winnings and losses, but not their size. In order that to get veritable independence, not only a sequence of winnings and losses must be independent but also sizes of winnings and losses in a sequence also must be independent. Winnings and losses can be independent, however much their sizes can depend on the results of previous transaction (or vice versa). A possible decision is conducting of serial test only with winnings transactions. It is thus necessary to divide the bars of winnings into long (as compared to the mean value of distributing of probability) and less long. Only it is after necessary to search dependence between the size of winnings transactions, after it it is necessary to conduct that procedure with losing transactions.

Search of optimum f

In the last decades gamblers were utillize the great number of the systems, known and exact from which is «System of rates of Kelli», being continuation of mathematical idea, pulled out at the beginning of 1956 John Ë. Êåëëè junior.

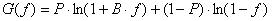

From a criterion Kelli ensues, that it is necessary to utillize the fixed stake of account (f), which maximizes the function of growth G (f):

(1) (1)

where f is the optimum fixed stake;

Ð is probability of winning rate or transaction;

is a relation of the won sum on a winning rate to the lost sum on a losing rate;

1n() it is a function of natural logarithm.

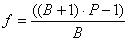

For the systems with two possible ends optimum f it is possible enough easily to find Kelli by formulas.

(2) (2)

or

(3) (3)

where f is the optimum fixed stake;

R is probability of winning rate or transaction;

Q is probability of loss (1 - R).

If winnings and losses would not be identical size, this formula would not give a right answer. The throw of coin exemplifies in a game «two to one», where all of winnings are 2 units, and losses are a 1 unit. In this case the formula of Kelli will look like the following:

(4)

(4)

where f is the optimum fixed stake;

R is probability of winning rate or transaction;

In is a relation of the won sum on a winning rate to the lost sum on a losing rate.

The formulas of Kelli are applicable only to the results which have distributing of Bernoulli (distributing with two possible ends). Application of formulas Kelli to other distributing is erroneous and optimum f does not give.

Fractional static f

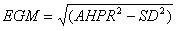

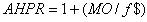

We will assume, it is known arithmetical mean HPR and geometric mean HPR for this system. It is possible to define standard deviation of HPR from a formula for the calculation of evaluation middle geometrical:

(5) (5)

where AHPR – arithmetical mean HPR;

SD is standard deviation of values of HPR.

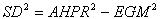

standartnoe rejection of SD:

(6) (6)

If to examine a game with the throw of coin 2:1, where the expected value 0,5 dollars and optimum f is a rate in a 1 dollar on each 4 dollars on an account, get geometric mean 1,06066. For determination middle arithmetic HPR can be used equalization (7):

(7) (7)

where AHPR – arithmetical mean HPR;

mo is the arithmetic expected value in units;

f$ - most looses/-f

f – optimum f (from 0 to 1).

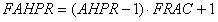

For transformation of value for standard deviation (or dispersions), arithmetic and middle geometrical HPR, to reflect trade not optimum f, but to some by his part, it is necessary to produce the followings calculations:

(8) (8)

FSD = SD * FRAC (9)

FGHPR= (FAHPR ^ 2 - FSD ^ 2) À^(1/2), (10)

ãäå FRAC – in-use fractional part of optimum f;

AHPR – arithmetical mean HPR at optimum f;

SD - is standard deviation of HPR at optimum f;

FAHPR – arithmetical mean HPR at fractional f;

FSD is standard deviation of HPR at fractional f;

FGHPR – geometric mean HPR at fractional f.

It is known at the use of strategy of fractional f, that earnings less than, than at optimum f. It is also known that losses and dispersions of incomes will be less than at fractional f. It is impossible to define that will happen in course of time, necessary for achievement of certain goal, it is possible to define the only expected amount of transactions, necessary for achievement of certain goal.

It not the same, that the expected time, required for achievement of certain goal, but, because measurings are produced in transactions, will consider time and amount of transactions

synonyms.

N = 1n(Purpose) / 1n(Geometric mean) (11)

where N is the expected amount of transactions for gaining end;

Purpose - is a purpose as a multiplier of primary account, I.e. TWR;

1n() it is a function of natural logarithm.

But trade with fractional f has one failing is greater time, necessary for achievement of certain goal. It is possible to inlay a money

in treasury obligations and attain the set purpose through set

time with the minimum intermediate falling of balance and dispersion

CONCLUSION

Trading in the fixed stake of account gives a most return in asymptotic sense, I.e. maximizes attitude of potential income toward a potential loss When the value of optimum f is known, it is possible to transform the daily changes of balance on the basis of one unit in HPR, to define arithmetic middle HPR and standard deviation of got HPR, and also to expect the coefficients of correlation of HPR between any two market systems.

The lack of approach, based on optimum f, consists in that f too depends on the size of most loss, that is a serious problem for many traders, and they prove that an amount of contracts which you open today must not be the function of one unsuccessful transaction in the past. For the removal of this ultrasensitiveness to the most loss various algorithms were developed.Many of these algorithms consist

in the change of most loss in a large or less side, to do a most loss the function of current volatil'nosti market.

LITERATURE

- R. Vins. Mathematics of management a capital. Methods of analysis of risk for traders and portfolio managers – M.: Al'pina Pablisher, 2001. – 400 p.

- Rayan Jones - The Exchange game - do millions playing numbers, Forexclub

- Appel' Dzh. Technical analysis. Effective instruments for the active investor of,Piter,2007.- 304 p.

- Min'ko A. the Statistical analysis in MS Excel: M.:"Vilyams",2004 y.- 448 p.

- Blank M. Management a capital. Educational course, El'ga,2004 y.-576 p.

|