Abstract on the master's workThe comparative analysis of money management’s dynamics algorithmsTable of contents

IntroductionThe successful functioning of a market economy is impossible without a developed and stable stock market. In the developed countries stock market is an important element of market infrastructure and subject to state regulation. In Ukraine, it is in a formative stage [1]. Today, there are a wide variety of approaches and algorithms to money managementThe main purpose of the dynamic money management (DMM) is to maximize capital with a minimum term. 1. Theme urgencyMany traders provide for trading fixed part of invested capital that does not lead to maximum profits and minimum risk. DMM affects the rate of increase in the account, which gives significant advantages of this subsystem. 2. Goal and tasks of the researchThe main goal of this research is analysis of the proposed methods of the dynamic money management, based on the theory of Ralph Vince. By the instrumentality of performance criteria to determine the most effective method of dynamic money management. Main objectives:

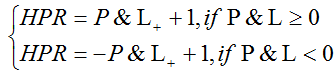

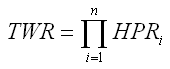

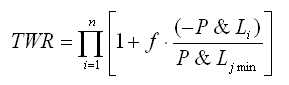

3. The basic principles of the theory of optimal f R.Vinsa.Modern portfolio theory is based on the assumption that investors have the ability to distribute the wealth among the many available areas of investment – to form an investment portfolio. The criteria for evaluating the effectiveness of investment decisions are the only two parameters – the expected return and standard deviation [2]. An efficient portfolio is the portfolio for which the maximum return for a given amount of risk or minimal risk for a given value of return. However, this theory does not include the issue of the optimal amount of investment capital. The answer to this question is given "experimental methods of money management". These methods took a dynamic money management (DMM). DMM is a young science, which is just beginning to develop. At the root of this theory is an American scientist, Ralph Vince, who developed the theory of optimal f. Ralph Vince proposed a model that consists of a series of P & L. It is a series of profits and losses. HPR is the profit for specified period (1 plus the level of income). Express P & L in terms of HPR:  TWR (Terminal Wealth Relative) – is the total revenue from a series of transactions as a multiplier to the initial capital. For example, if the income is 12%, the TWR = 1.12. Or, if the loss is 18%, the TWR = 0.82 It is ease in that it is possible to compare the results of the various processes of trade, regardless of the absolute value of the initial capital [3]. The relationship between TWR and HPR can be represented as:  Ralph Vince takes the definition of “optimal f”, which is part of the investor's capital at the maximum TWR. With the statistics of wins and losses we can find f for maximum TWR.  where, f – percentage of funds to be reinvested; (-P & L) – profits and loss with opposite sighns; P & Lj min – the biggest loss; f – one of the values of f , when TWR = TWRmax.

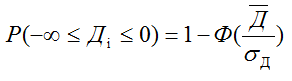

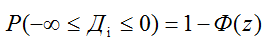

Figure 1 – The schedule of finding the optimal f By Ralph Vince f is part of the capital, which is reinvested. This value can range from 0 to 1. For investment risks, which tend to 0, "the optimal f" will tend to 1, this means that a trader can use almost all capital. Comparison of dynamic money management was conducted by finding the ruin probability of business system. The ruin probability of business system – is probability to achieve the current return Дi < 0. This indicator provides an opportunity to identify the most vulnerable sections of the system, and also allows to compare the algorithms. Chance of a ruin on the i-th step can be defined as:  or  where, σд – standard deviation; Ф(z) – tabulated integral, function Laplace. ConclusionThe main objectives of the investor: преумножать of investment capital and minimizing the overall risk. This can be achieved through quality management of investment capital. It is important to choose the right algorithm for the dynamic money management, using the performance criteria. The above modification of the method of optimal f suggests that the method of Vince is not optimal, since the algorithm can be significantly improved by transformation. This master's work is not completed yet. Final completion: December 2012. The full text of the work and materials on the topic can be obtained from the author or his head after this date. References

|

– average return

– average return