Abstract

Content

- Introduction

- 1. Relevance

- 2. Purpose of the research and expected results

- 3. Simulation of the control system of commercial bank deposit operations

- Conclusion

- References

Introduction

The essence of the banking business is to generate income from operations, one way or another connected with the resources generated by the accumulation of customers’ funds. The raised funds of banks cover over 90% of the needs for financial resources for the implementation of active operations. The role of the borrowed funds is extremely high, since, by mobilizing available cash flow of physical and legal persons in the credit market, the commercial banks with their help meet the demand of the economy for additional working capital, contribute to the transformation of money into capital, provide the needs of the population in the consumer credit.

With the transition to a market economy model condition of the banking system have significantly altered. Resources of national loan fund have significantly narrowed, there are entirely new conditions for mobilization of funds by banks appear, market of banking resources is forming and competition is developing among banks for raising funds.

1. Relevance

To ensure the stable and secure operation of commercial banks is our country formation of scientifically based banking policy, the main element of which is the deposit policy, plays an important role. This is due to the fact that the main part of bank resources is created in the process of deposit operations, which efficiency and accuracy of the organization the stability of the banking institution depends on. Growth in the number of investors depends on the deposit policy, so the dynamics of investors growth is an indicator of the efficiency of the bank.

2. Purpose of the research and expected results

The purpose of the graduation thesis is to study the mechanism of formation of the deposit portfolio of the bank, the development of an integrated system-dynamic model of the formation of deposits and practical recommendations for optimizing the deposit policy.

The object of research: process of managing the involvement of the Bank's resources from deposit sources.

The subject of research : mechanism of control of the bank deposit policy and its impact on the activities of the institution.

In the course of the study a general science, and special methods of research were used: scientific methods and empirical methods, namely: analysis and synthesis, abstraction, induction, deduction, generalization, tabular and graphical, mathematical and statistical methods, and methods of system dynamics simulation.

The resulting system-dynamic model will highlight the key factors influencing the formation of the deposit resources and get the predicted values of the volume of deposit portfolios.

3. Simulation of the control system of commercial bank deposit operations

The most significant and important source of formation and increase of the resource base of commercial banks in favor of deposit operations.

According to the Regulation on the Procedure of carrying out deposit operations by Ukrainian banks with legal and physical individuals deposit operation is the operation of the bank to attract money or precious metals from investors on their bank accounts on the basis of agreement or deposit cash with the designing of savings (deposit) certificates.

Deposit not only benefits the investor, but also does to the bank. The set is capable of creating bank deposits loan capital, which it then posts on favorable terms in any field of economy. The difference in the percentage of deposits and interest received from borrowers of capital, is a reward for bank’s work in attracting free cash flow and placement of loan capital, called the interest margin.

Classification of deposits is carried out on different grounds. Thus, according to the terms of use deposits can be:

- demand deposits;

- term deposits;

- escrow.

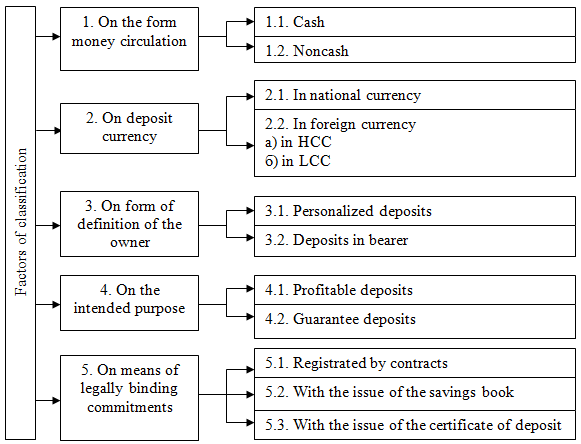

In addition to the classification of deposits on borrowing term, they can be classified on other factors listed below (Fig. 1).

Figure 1. Classification of deposits

Banks pay for the use of the funds to their owners the appropriate fee in the form of interest set differently according to the type of deposit, the retention period, amounts. The value of deposit interest commercial bank installs itself on the basis of the NBU discount rate, market conditions and its own deposit policy.

Performance of science-based deposit policy should encourage businesses, organizations and the public to keep their current income and savings on various deposit accounts at banks and motivate the development of various types of deposits, the introduction of new and more advanced forms of deposit accounts [22, p. 26].

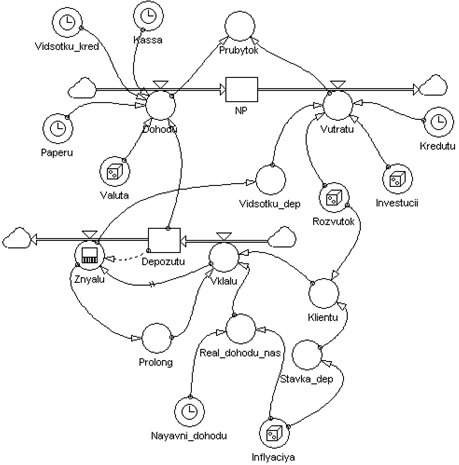

Based on the above, for a more detailed study and analysis of the mechanism of attracting deposits in the bank, as well as to determine their place in the formation of bank profits a diagram of cause-and-effect relationships was built (Fig. 2).

Figure 2. Diagram of cause-and-effect relationships

(animation: 3 frames, 5 cycles of repeating, 31 kilobytes)

Basing on the diagram of cause-and-effect relationships, shown in Figure 2, and the reporting of "UkrSibbank" for 5 years a system-dynamic model of the bank was developed.

The model allows us to predict the number of customers involved, the amount of funds invested in deposits and, as a key figure, the profit of the bank, to identify areas of difficulty and take management decisions to optimize the activities of the bank.

Scheme of the model of the bank deposit activity, the construction of which was carried out in graphic user interface package PowerSim, is shown in Figure 3.

Figure 3. Model of the deposit activity of the bank, implemented in software product PowerSim

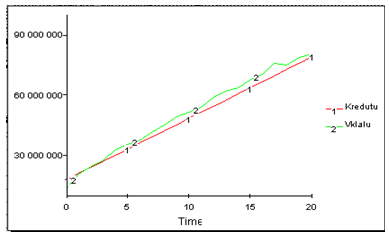

As the model shows, the difference between raised funds and credits is quite small, indicating the equivalence of the bank deposit and lending its activity (Fig. 4). During the forecast period, this difference does not change significantly, but the volume of deposits increased due to the growing number of clients.

Figure 4. Forecast the amount raised funds and loans

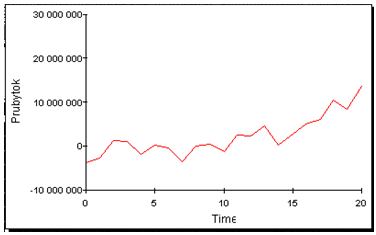

Looking at Figure 5, we see the growth in deposit funds increases the profit of the bank, so the bank can and should pay attention at the further development of more efficient deposit operations.

Figure 5. Prediction of bank profits

Deposit policy "UkrSibbank" has to be coherent with the credit policy and ensure the implementation of the latter. This approach is now able to provide liquidity, financial stability and profitability of commercial banks at the same time.

Conclusion

The developed system-dynamic model gives the bank the ability to predict the amount of deposits by a given deposit policy.

In order to increase the growth rate of profit of the bank a number of recommendations has been developed to improve the efficiency of the deposit operations organization of "UkrSibbank", among which the active use of interest rate policy as a method of stimulating allocation to the various types of deposits, the introduction of deposit accounts with mixed-mode operation, expanding the involvement of customer funds on savings deposits, an integrated client service.

References

- Закон України «Про систему гарантування вкладів фізичних осіб». {Зі змінами, внесеними згідно із Законом № 5411-VI від 02.10.2012}

- Агапова Т.М., Бехренс Д., Курран Д. Динамические системы в экономике. – Донецк.: ДонГУ, 2000. – 140 с.

- Аникеев М. Депозитные операции банков // Вестник Ассоциации белорусских банков. 2003. №19. С. 21–23

- Бартош О. Депозитна політика банку та основні етапи її формування / О. Бартош // Вісник УБС НБУ. – 2008. – № 3. – С. 97–101.

- Бушуєва І.В. Основні напрямки забезпечення прибутковості комерційного банку за рахунок вдосконалення його менеджменту і діяльності / Бушуєва І.В.// Банківська справа – 2002. – №6 – С. 36-38.

- Васюренко О., Азаренкова Г. Математичні методи і моделі у сфері аналізу та управління банківською діяльністю // Вісник Національно- го банку України. 2003. № 8.

- Волошин І. Динамічна модель грошових потоків ідеального процентного банку // Банківська справа. 2007. № 2.

- Клебанова Т.С., Дубровина Н.А., Полякова О.Ю., Раевнева Е.В., Милов А.В., Сергиенко Е.А. Моделирование экономической динамики: Учебное пособие. – 2-е изд., стереотип. – Х.: ИД «ИНЖЭК», 2005. – 244 с.

- Клебанова Т.С., Гурьянова Л.С., Богониколос Н., Кононов О.Ю., Берсуцкий А.Я. Моделирование финансовых потоков предприятия в условиях неопределенности: Монография / Т.С. Клебанова, Л.С. Гурьянова, Н. Богониколос, О.Ю. Кононов, А.Я. Берсуцкий. – Х.: ИД «ИНЖЭК», 2006. – 312 с.

- Коноплицкая М.А. Банковские операции: пособие. – Мн. Высшая школа, 2008. – 315 с.

- Красс И.А. Математические модели экономической динамики. – М.: Сов. Радио, 1985. – 280 с.

- Лавінський Г.В., Пшенишюк О.С., Устенко С.В., Шарапов О.Д. Моделювання економічної динаміки: Навчальний посібник. – К.: Атіка, 2006. – 276 с.

- Лаврушин О.И., Валенцева Н.И., Мамонова И.Д. Банковское дело: Учебник. – М.: КноРус, 2011. – 352 с.

- Мельникова І.М. Маркетингові аспекти формування депозитної бази комерційного банку // Банківська справа. – 2005. – № 3. – С. 40-41.

- Олійник Д. Ресурсна база українських комерційних банків як джерело ліквідності // Банківська справа. – 2008. – №2 – С. 42-44.

- Осипенко Д.В. Динамічна модель комерц- ійного банку // Фінанси України. 2005. №11.

- Петухов О.А., Морозов А.В., Петухова Е.О. Моделирование: системное, имитационное, аналитическое: Учебное пособие. – СПб.: издательство СЗТУ, 2008. – 288 с

- Роуз Питер С. Банковский менеджмент [Текст] : Пер. с англ. со 2-го изд. – М.: Дело ЛТД, 2005. – 768 с.

- Румас С., Плешкун А. Средства населения в ресурсной базе банков // Банковский вестник. – 2006. – №7. С. 12–19.

- Сидоренко В.Н. Системная динамика. – М.: Экономический ф-тет МГУ; ТЕИС, 1998. – 208 с.

- Синки Дж.Ф. младш. Управление финансами в коммерческих банках.: Пер. с англ. – М.: Catallaxy, 1994. – 937 с.

- Тарасов В.И. Взаимосвязь депозитной политики, депозитного и ссудного процента // Вестник Ассоциации белорусских банков. 2003. №27. С. 24–30.

- Форрестер Дж. Основы кибернетики предприятия (индустриальная динамика): Пер. с англ. – М.: ПРОГРЕСС, 1971. – 340 с.

- Цисарь И.Ф., Нейман В.Г. Компьютерное моделирование экономики. – М.: Диалог-МИФИ, 2002. – 304 с.

- Череп А.В., Андросова О. Ф. Банківські операції: Навч. посібник. – К.: Кондор, 2008. – 410 с.