Abstract

Contents

- Introduction

- 1 Actuality

- 2 Goal and tasks of the research

- 3 Content

- 3 1 Theoretical basis of methods of lending

- 3 2 Development of theoretical propositions innovative sources of financing

- 3 3 Recommendations on the economic development of the company through alternative methods of credit

- Conclusions

- References

Introduction

The processes occurring in the global economy at the present time, – strengthening of inflationary tendencies, the increase in the general economic instability, the problem of non-payment, including the calculation of commercial bills, leading to an increase in economic risks in payments between economic entities, which necessitates the use of both companies, banks and the economy as a whole factoring and forfeiting operations.

Factoring and Forfeiting lending as a form of foreign trade theory have long been known, but a long time had been available to a limited number of users

. Therefore, the development of these types of services makes it particularly urgent consideration of the nature of these foreign forms of lending. In addition, operations of factoring and forfeiting the CIS has a number of features, which is due to the specifics of national legislation, and purely by market forces.

1. Actuality

The economy of any developed country is the small and medium business, for the operation and sustainable development of the business must be attraction various resources. Limited financial resources, encourages companies to seek new sources of funding for its activities. The solution to this problem is possible by means of specific forms of lending companies that allow you to increase your sales, product range, provide access to new markets, expand its customer base and the company's market share and more.

2. Goal and tasks of the research

The aim of the research is the development of theoretical positions and the establishment of guidelines for the management efficiency of the use of alternative methods of credit for the development of the enterprise.

Main tasks of the research:

- Examine the current state of the investment activity.

- Define the essence of traditional and alternative lending.

- To analyse the economic aspects of factoring and forfеiting.

- Conduct a comparative analysis of factoring and forfeiting transactions.

- Improve the approach to the formation methods of evaluating the effectiveness of factoring and forfеiting.

- To investigate the effect of lending on economic reeks enterprise.

- Develop a rationale for the decision on the choice of the use of factoring and forfeiting the enterprise.

- Review the use of factoring and forfеiting for economic development enterprise.

Research object: are investment processes in the company with specific forms of credit.

Research subject: theoretical aspects of scientific and methodological approaches lending.

3. Content

3.1 Theoretical basis of methods of lending

In modern conditions of functioning of the enterprise, periodically forced to resort to attract additional financial resources for the normal operation and development of their activities. Many businesses are in need of re-equipping the material and technical basis in connection with the moral and physical obsolescence. Known methods of lending businesses: credit, leasing, factoring, forfeiting.

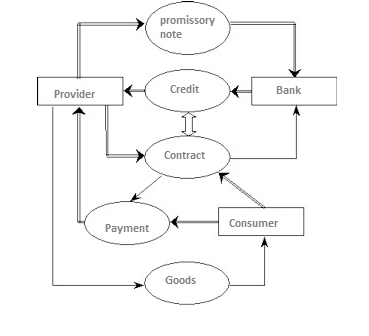

Picture 1 – Ways of lends(animation: 5 pages,74,8 KB, 6 cycles of repeating)

Credit provides faster wrapping capital because of the purchased goods can be paid later on, as well as the capital increase by raising funds from other banks and companies. In enterprises increasingly there is a need of borrowing, for its operations and profit [13].

Under the form of a loan to understand the movement of loan capital, the provision of money or goods on credit, as a rule, the payment of interest; Cost economic category, an essential element of the commodity-money relations. The emergence of credit directly related to the scope of the exchange, where the owners of commodities confront each other as owners who are ready to enter into economic relations [14].

Picture 2 – Commercial loan scheme

One of the most effective ways of raising capital for companies, as evidenced by international experience, is leasing. Leasing is a fairly complex and multifaceted concept, which includes the purchase and sale, rent, as well as the investment of financial and business [1].

Leasing - form of financial services, a form of credit on the acquisition of fixed assets by enterprises or very expensive goods by individuals. The lessor undertakes to acquire ownership of certain lessee from the seller and said they give the lessee the property for payment for temporary possession and use of [1].

The increasing spread of the world's banking services are gaining factoring and forfeiting. Factoring – Operation buy the lender on the basis of non-recourse debt, expressed as a working document. This definition brings the fact that the buyer of the debt, which is called forfeiter, commits itself to refuse – forfeiting – from treatment of regressive demands to the lender if you can not obtain satisfaction from the debtor. Turnaround obligation to buy at a discount [3].

In world practice, the following types of factoring:

- Buying factor payment creditor's claims against the borrower.

- Provide factor creditor range of services, which in addition to the assignment of the right to demand debt include the introduction of accounting on these requirements, the analysis of information about the debtor's financial situation, providing credit insurance, advertising, warehousing, transportation, consulting and legal services [6].

In factoring transactions involves three parties:

- Factoring company (or a department of the bank's factoring)–Specialized organization receiving the account - invoices from its customers (creditors, suppliers).

- Client (lender, provider of the goods).

- The borrower (enterprise) – consumer goods company [7].

Due to the fact that the entire risk of non payment of accounts assumes a factor (a bank or a company), it is the customer pays up to 80 -90% of the total amount of accounts and other debts leave reserve, which will be refunded after the debtor repayment of the entire amount of the debtor of the debt [4].

3.2 Development of theoretical positions of non-traditional methods of credit

The comparative characteristic of factoring and forfeiting transactions.

So, the difference between the financial transactions due to the peculiarities of their conduct. Factoring lasts a maximum of 180 days, forfeiting – up to several years. Forfeiter assumes all risks, from the payment and ending political. Factor shifts the responsibility to the client, if the obligation is not fulfilled, the factor is entitled to demand the return of their funds (to minimize risk using insurance).

Finally, the supplier sends a factor of the money on the deal, else – after the implementation of the commitments. Forfeiter fully calculated to the seller, and its commitment in the future may sell. Transfer factoring to third parties is not possible.

For efficient use of these banking instruments is necessary to develop a system of criteria for their choice in a given situation. The system should be based on a thorough analysis in the first place, the scheme is applicable factoring in industries such as the wholesale trade and manufacturers is needed, as well as those companies which operate essentially on credit terms. Secondly, factoring is beneficial when it comes to any regular deliveries of a wide range of regular customers. It could be food, consumer goods (household chemicals, perfumery and cosmetics, household appliances, etc.), medicines, supplies for offices, drinks and much more. Factoring is suitable for companies engaged in regular supply of goods, because only in this case, the most valuable services a factor for receivables management. Thirdly, factoring applies not only to supplies of goods but also of services (for example, communication services, transport, tourism and other) [8].

Factoring benefits for developing companies, because in the dynamic growth of additional income from the increase in sales volumes significantly higher than the costs of remuneration of the factoring company

The use of factoring services most effectively for small and medium enterprises with prospects of increasing production and facing the challenge of a temporary shortfall of cash because of delayed repayment of debts of debtors and the difficulties associated with the production process. Forfeiting mechanism used in two types of transactions:

- Financial transactions – with a view to the rapid implementation of the long-term financial commitments.

- In export transactions – to facilitate the flow of cash to the exporter, provided a loan to the foreign buyer.

If you compare both types of lending, it should be noted that factoring is most effective for small and medium-sized enterprises, which have traditionally experienced financial difficulties because of delayed repayment of debts of debtors and the limited sources available to them credit. Forfeiting is most effective for large enterprises that aim to accumulate funds for the implementation of long-term and expensive projects [9].

3.3 Recommendations for the economic development of the company through alternative ways of lending

In an unstable economy, the company can develop harmoniously resorting to unconventional methods of financing their activities.

From the standpoint of cash factoring solves problems such as:- Enhanced market share. At the supplier an opportunity to attract new customers, increase the range of goods in a warehouse and as a consequence, increase turnover and profits.

- Increase the liquidity of receivables. Supplier receives the money immediately after the shipment of goods with deferred payment. Financing paid automatically increased as sales growth.

- The liquidation of cash shortages. Accurate planning cash flows and repayment of private debt. The supplier can build a repayment plan factoring financing "under his company": getting paid on the day when it is necessary and it is to the extent that some required at the moment.

- The timely payment of taxes. Funded as part of factoring services in the day of delivery, the supplier will not be disturbed, "estimates" with the state. Company-supplier receives a guarantee of protection from penalties by the creditor (including government agencies) at untimely calculations with them, caused by cash shortages. A further possibility is for funding to date tax payments.

- The timely payment of contracts. Reducing credit period on purchases of goods leads to better price conditions for purchased goods and an increase in the size of trade credits received from suppliers of their own [10].

The commercial aspect of the effectiveness of factoring reflected in the fact that the bank supports in terms of credit management. The Bank monitors the timely payment of deliveries by buyers, checks the payment discipline and business reputation of customers to effectively manage accounts receivable. The Bank within the framework of factoring allows the customer to manage their risks, to avoid unfair shipments to customers, competently build limit and tariff policy for commercial lending [11].

Furthermore, when factoring service provider protected by weight risks. It is, above all, credit risk, non-payment by the buyer delivery at all, the risk of violation of the liquidity risk of late payment and foreign currency risk (the risk that the course of, say, a dollar in the period of deferred payment on delivery) [12].

Forfeiting the deal, of course, have several significant advantages over other types of foreign trade operations associated with lending. Firstly, the bank, in this case fully assumes all risks of operation. Second, we are actively developing market forfeiting of securities in which the debt can be quite profitable to sell. At the same time the full amount of the debt obligations can be divided into pieces, making out a separate bill for each of these parts (respectively, to sell on the market can not only all the debt as a whole, but also its individual parts). In addition, forfeiting is a fairly flexible form of lending – in particular, it is possible to make debt payments to the provision of a grace period (by agreement of the parties) [10].

Conclusion

Both methods of lending are unique and demand economies of different countries. The feasibility of using one or the other method is determined by the objective pursued by the creditor (seller, exporter):Factoring services most effectively for small and medium-sized enterprises, which have traditionally experienced financial difficulties because of delayed repayment of debts of debtors and the limited sources available to them credit. This method is even more interesting for these companies, as supplemented by the elements of accounting, information, advertising, marketing, legal, insurance and other services to the creditor (the client), which enables customers to focus on production and cost savings on wages.

Forfeiting is most effective for large enterprises that aim to accumulate funds for the implementation of long-term and expensive projects.

This master's work is not completed yet. Final completion: June 2016. The full text of the work and materials on the topic can be obtained from the author or his head after this date.

References

- Башкатова, С В. Лізингове фінансування інноваційної діяльності в Україні [Текст] / С. В. Башкатова // Вісник Хмельницького національного університету. Економічні науки. – 2007. – № 6,Т.2. – С. 67–72.

- Лизинг [Электронный ресурс]. – Режим доступа: https://ru.wikipedia.org/wiki/%CB%E8%E7%E8%ED%E3.

- Форфейтинг [Электронный ресурс]. – Режим доступа: http://profmeter.com.ua/Encyclopedia/detail.php?ID=728.

- Информационный портал о факторинге [Электронный ресурс]. – Режим доступа: http://www.factorings.ru/static/description/.

- Инвестиции в России [Электронный ресурс]. – Режим доступа: http://www.investmentrussia.ru/kreditovanije/lizing-faktoring/forfeitnig.html.

- Ростовский Ю. М. Внешнеэкономическая деятельность: учебник для студентов вузов, обучающ. по спец. 060600 Мировая экономика / Ю. М. Ростовский, В. Ю. Гречков. – 2-е изд., с изм.. – М.: Экономистъ, 2009. 588 с.

- Хромов М. Ю. Дебиторка. Возврат, управление, факторинг. -СПб. Питер, 2008. – 252 с.

- Адамова К. Р. Факторинговые операции коммерческих банков // Бизнес и банки, 2008. – № 15. – С. 22–24.

- Дякин Д. Факторинг на службе бизнеса // Управление компанией, 2009. – № 6. – С. 24–27.

- Лаврик М. Ю. Риски факторинговых операций // Банковское дело, 2010. – № 7. – С. 45–47.

- Лазарева Т. П. Нетрадиционные формы кредитования внешнеэкономической деятельности // Право и экономика, 2011. -№ 1. – С. 15.

- Милых Ф. Г. Кредитование внешнеэкономической деятельности // Практика международного бизнеса. – 2010. – № 6. С. 77–105.

- Семикова П. Механизм и базисные параметры форфетирования // Банковские технологии. – 2009. – № 9. – С. 57–60.

- Сухов Д. А. Факторинговые операции: сущность, бухгалтерский учет, налогообложение // Финансовые и бухгалтерские консультации, 2008. – № 4.–C.71–77.