Tatiana Klekovkina

Economy Faculty

Department of Economics of Enterprise

Speciality Economics of Enterprise

Increase of investment appeal of the entity on the basis of development of its intellectual equity

Scientific adviser: Ph.D., Professor Valentina Khobta

Abstract

Content

- Introduction

- 1. Theoretical bases of formation of investment appeal of the enterprise

- 2. Development of the intellectual capital for increase of investment appeal of the enterprise

- 3. Methodical recommendations concerning development of the intellectual capital at the enterprise

- Conclusion

- References

Introduction

At the present stage enterprise work in the conditions of the rigid competition. Therefore there is a requirement constantly to be differentiated and improve the activity for the subsequent functioning in the market and competitiveness increases. This requirement is especially pointed for the Ukrainian enterprises which are characterized by inveteracy of fixed assets, low level of technologies and unprofitability about 41 % of subjects of managing.All this demands the considerable volumes of investment. So, by estimates of the Ministry of economic development and trade of Ukraine, the need for investment resources of the country makes about 400 billion dale. USA. Considering limited by results of activity of possibility of the enterprises and conditions in the credit market, it is necessary to take measures concerning increase of investment appeal of the enterprises. For this purpose it is necessary to use all existing factors and reserves among which the increasing value gets development of the intellectual capital.

1. Theoretical bases of formation of investment appeal of the enterprise

Question of attraction of investments into economy always took the central place in economic science. It is connected with that investment is basic process of expanded reproduction and the solution of modern problems of domestic economy which in turn influences socio-political position of the country. High level of investment appeal guarantees stable receipt of investments into the country that provides additional receipts in the budget of the state and improves the social environment [1].

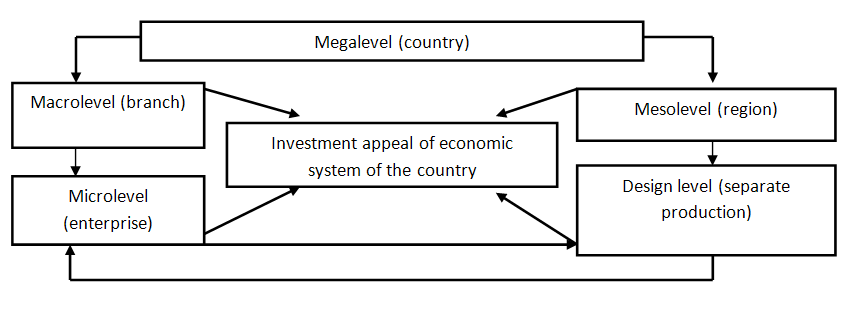

Investment appeal of the enterprise can be considered at several levels: at the level of the state, the region, branch, and directly at the level of the enterprise.

Making the decision on capital investments in this or that investment object, the investor considers investment appeal in a complex (fig. 1.1.). The investor needs to consider ensuring high appeal at all stages of investment decisions, from a country recipient choice – to definition of the specific investment project. From here it is obvious that investment appeal has the aggregated character: the lowest level of appeal is a component of the highest level. And, therefore, all levels of investment appeal are interconnected [4].

2. Development of the intellectual capital for increase of investment appeal of the enterprise

In the course of creation of information society when the intelligence comes to the forefront, the office of the intellectual capital as important factor of investment appeal is expedient. We will begin determination of importance of this factor, first of all, from specification of its essence. K. Sveybi treated the intellectual capital as set of immaterial assets, carrying to their number as individual intellectual values (knowledge and experience of workers), and those from them that the organizations as a whole (duty regulations, the software, methodical instructions, from performance of concrete works, and so forth belong). According to the author, each of these assets can bring to firm one of four types of benefits: to accelerate company growth, to increase profitability, to maintain stability or to increase efficiency of separate business processes and firm activity as a whole [10]. Therefore, what benefit would be not brought to the enterprise by the intellectual capital, it, undoubtedly, will increase its investment appeal.

Fig. 2.1 - Block diagram of components of the intellectual capital

(animation: 6 frames, 15,4 kilobyte)

3. Methodical recommendations concerning development of the intellectual capital at the enterprise

In the third section it is planned to allocate in the course of determination of investment appeal of the enterprise the separate block of indicators directed on an assessment of the intellectual capital of the enterprise and to estimate level of increase of investment appeal of the enterprise at the expense of development of its intellectual capital.

For this purpose it is necessary to execute some stages. At the beginning the assessment of the intellectual capital existing at the enterprise is carried out. There is an introduction of actions for improvement of the intellectual capital on the basis of quantitative characteristics further.

At the following stage search of factors of development of the intellectual capital and a choice of the most influential of them is carried out. After that it is necessary to define expenses on introduction of the chosen actions and to establish expected results.

Taking into account the received characteristics change of investment appeal of the enterprise will be carried out and the motivation of investors concerning capital investments in them will amplify.

Conclusion

On the basis of the conducted researches theoretical generalization is carried out and the solution of a number of topical scientific and practical issues on increase of investment appeal of the enterprise and development of the intellectual capital is proposed. The main conclusions and results are reduced to the following:

- At the present stage as showed the analysis of statistical information, investment appeal at all its levels demands increase. Search and use fully all existing factors and reserves of increase of investment appeal of the enterprise is important.

- In the course of creation of information society when the intelligence comes to the forefront, development of the intellectual capital is the most progressive of all existing factors. Such approach will provide essential increase of investment appeal of the enterprise and will expand its opportunities in implementation of investment processes.

- In the course of determination of investment appeal of the enterprise were allocated the separate block of indicators directed on an assessment of the intellectual capital of the enterprise. After introduction of actions for its development it is possible to observe essential increase of investment appeal of the enterprise and as increases of motivation of potential investors to make in it investments.